Home » Tri-City retail sales grew last summer, fall – but not at restaurants

Tri-City retail sales grew last summer, fall – but not at restaurants

March 15, 2021

Of all the shocks that buffeted the Tri-Cities last year, here’s one that few people know about: the economy grew in late summer and early fall.

In data just out from Washington State’s Department of Revenue, taxable retail sales went up by 4% from the third quarter of 2019. Even more surprising, the number of firms in the two counties climbed by 10% from the same quarter of the prior year. In the jaws of an economic panic, entrepreneurship flourished.

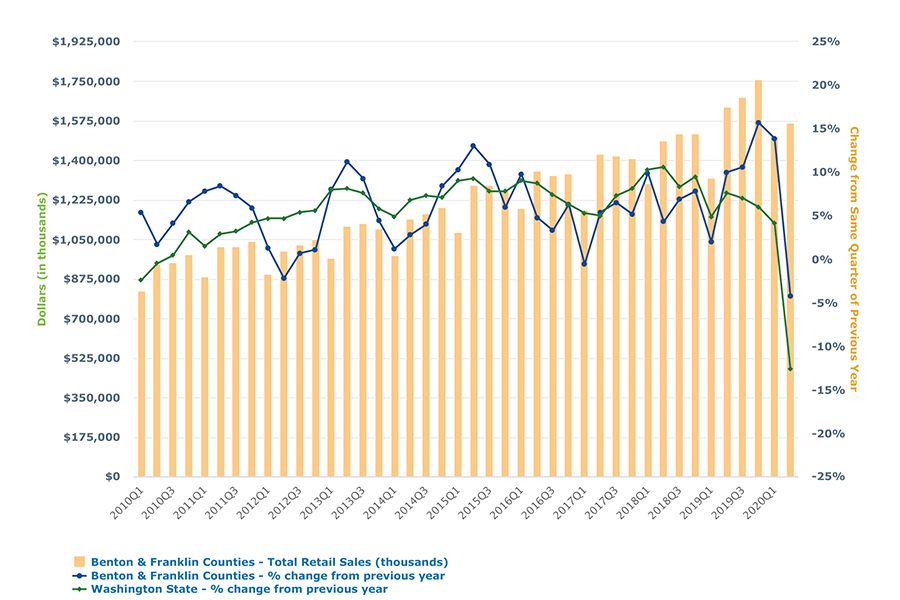

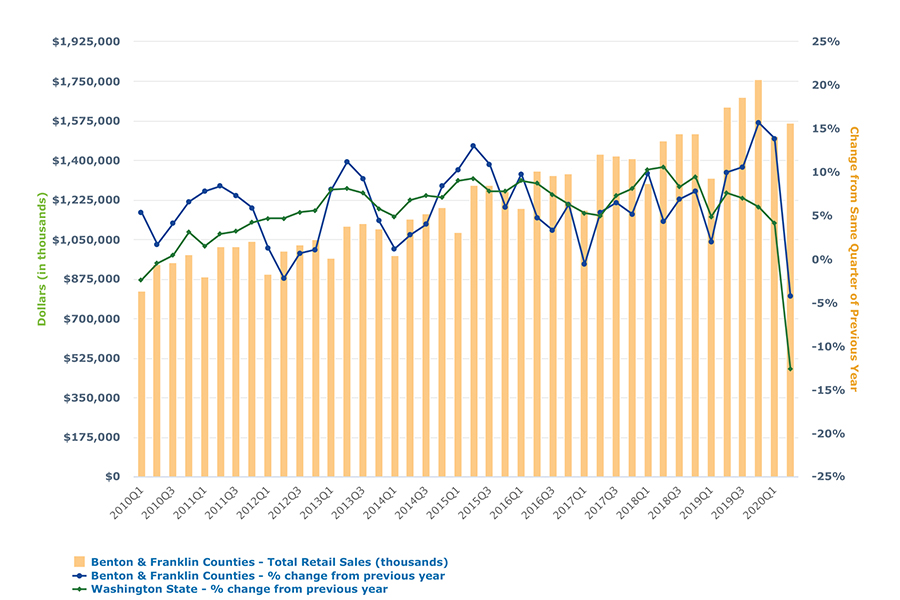

To track the rise in taxable sales, refer to the accompanying chart.

What’s behind this resumption of overall economic normality in the middle of a pandemic?

A few thoughts come to mind.

First, the initial federal stimulus dollars and extension of unemployment benefits began to impact incomes and therefore spending by Tri-Citians.

Second, after the near lockdown in the spring, pent-up demand for goods and services in the local economy was strong.

Third, the area is a regional retail hub and its big box stores likely attracted out-of-county shoppers.

Fourth, the area’s agricultural sector, in the top five as defined by workforce (go to this Trends indicator) was deemed an essential industry and no lockdowns took place beyond those required by Covid-19 infections.

For sure, taxable retail sales don’t capture all the activities that are counted in a complete measure of the economy, such as Gross Metro Product. Notably absent is the government sector, as well as the quasi-government sector, such as the Hanford cleanup mission.

But since our state extends the sales tax to activities far beyond retail sales, and since retail sales are driven by income, and since total personal income and metro GDP are two sides of the same coin, it is highly likely that the greater Tri-City economy expanded year-over-year.

For those readers statistically minded, the correlation between metro GDP in the two counties and annual taxable retail sales over the period 2002-18 wasn’t perfect, but close to it, at 0.94 (Correlation coefficients run between -1.0 and 1.0, with the latter number implying perfect co-movement in the same direction of the two measures.)

Within the state, the greater Tri-City area was not alone.

Nearly all Eastern Washington counties, with the exception of Grant County, experienced year-over-year taxable retail sales growth in the third quarter.

Somewhat puzzling, King County witnessed a steep drop of more than 8%. Since its experience strongly influences state results, Washington state’s numbers declined ever so slightly, at -0.1%. This is visible in the graph.

And yet, the local gains were far from evenly distributed among the economy’s sectors.

The largest retail trade sector, motor vehicles, posted an 8% year-over-year bump, twice the two-county total rate.

All retail “transportation” industries shone well, but sales of RVs and boats particularly sparkled, with a 14% increase.

The second largest (taxable) retail sector, general merchandise (big box) stores, experienced a 7% increase in sales. Among the winning retailers, building materials and gardening stores saw their sales shoot up an astonishing 20%.

Not all has been well in retail, however, as apparel and jewelry stores suffered double-digit declines.

But measured by their contribution to the local economy, sales at restaurants, bars, caterers and coffee shops fared worse.

On a year-over-year basis, their taxable plummeted 17% in the two counties. The decline is attributable to the necessary public health restrictions to combat Covid-19.

The downturn followed on the heels of a 32% year-over-year plunge in the spring (second quarter).

In light of these jaw-dropping challenges, it is hardly surprising that the number of firms in the restaurant sector of the two counties at the end of September was 98 fewer than in September 2019. This represents nearly a fifth (18%) that were no longer in business. The number at the end of December was likely lower yet.

Within the entire sector, there have been relative winners and losers.

Detailed data on the sector in the Tri-Cities doesn’t exist, although insights can be gleaned at the state level. But detailed state third quarter numbers from the Department of Employment Security aren’t yet out.

If local experience tracks national trends, which is likely, winners have been restaurants with drive-thrus and national chains offering limited menus. In other words, most of the food businesses that have closed their doors are locally owned.

And the outlook for the entire sector once a level of herd immunity is reached so dining out can become normal again? This observer of the local economy doesn’t pretend to be a restaurant expert. But based on national surveys and reports, some predictions over the next two years seem safe:

- Restaurants of national chains will continue to gain market share.

- Restaurants and coffee shops with drive-thrus will do relatively well.

- Dine-in restaurants will still meet hesitation from a significant portion of Americans.

- Grocery stores, winners since the pandemic’s sanctions, likely will hold on to a good part of their gains. At least we are rediscovering the joy of cooking.

D. Patrick Jones is the executive director for Eastern Washington University’s Institute for Public Policy & Economic Analysis. Benton-Franklin Trends, the institute’s project, uses local, state and federal data to measure the local economic, educational and civic life of Benton and Franklin counties.

Food & Wine

KEYWORDS march 2021