Home » Visitor spending continues its recovery but will still be below 2019 levels

Visitor spending continues its recovery but will still be below 2019 levels

March 11, 2022

As we might suspect from our own travel, tourism took a huge hit in 2020.

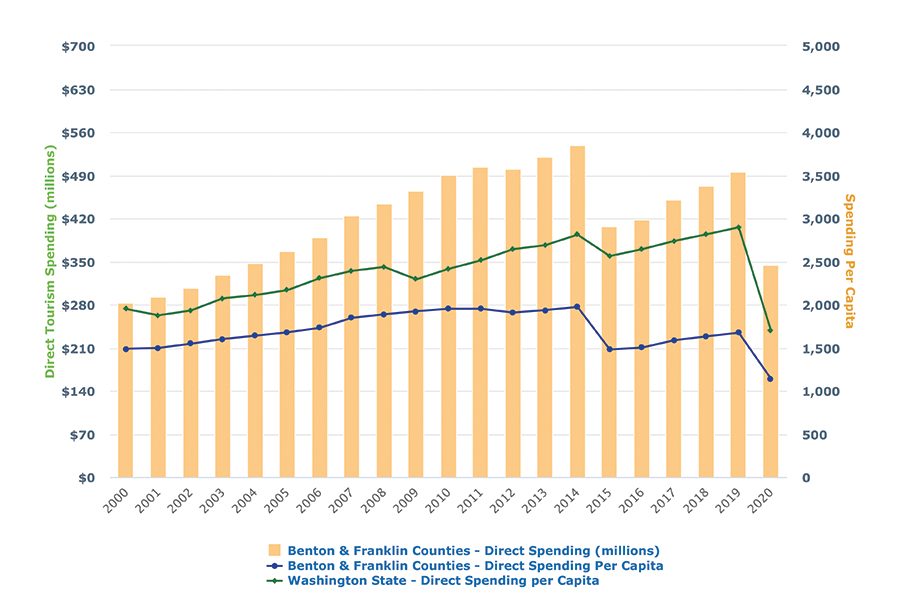

The Benton-Franklin Trends metric on direct travel and tourism spending makes this painfully clear.

Total estimated spending in the two counties plunged from about $496 million to $345 million, or a drop of 30%.

What has been affected? According to Tourism Economics, by way of the Washington State Tourism Alliance, retail spending was the largest category by visitors to the greater Tri-Cities, just a bit ahead of food and beverage. Accommodations ranked third, while entertainment and recreation spending landed in fourth place.

Since there is no turnstile at the county borders where people declare themselves residents or visitors, readily accessible data from the Washington State Department of Revenue (DOR) mixes both resident and visitor spending, with one exception – accommodations, where the bulk of the industry’s revenue stems from visitors.

Tourism Economics uses multiple sources of data, including surveys, likely national ones, that are assumed to hold locally.

The Trends doesn’t track tourism spending categories separately, except for accommodations. It shouldn’t surprise anyone that the spending at hotels and motels in the greater Tri-Cities took a plunge similar to overall estimated tourism spending. Reported sales in 2019 were about $93 million; a year later, $50 million.

In recent work on the Tri-Cities’ economy for the Port of Kennewick, EWU’s Institute has compiled quarterly details of the hospitality industry.

This designation combines the food and beverage sector with accommodations.

Measured by the percentage drop in the second quarter of 2020, hospitality in the two counties fared nearly the worst in the local economy.

In those three months, employment dropped 29% from the same quarter in 2019, total wages sank by 30% and sales slid by 39%. The sector where numbers dipped even further was arts, entertainment and recreation.

Yet a year later, the landscape for hospitality firms was much greener. Employment in the second quarter of rose 35% over the prior year. This still didn’t bring the sector back to 2019 levels. Total wages paid, however, was a different matter. In the second quarter of 2021, the sector’s wage bill skyrocketed by 63% over the same quarter in 2020. That put the level above the same quarter in 2019.

Taxable retail sales rose at an even dizzier pace, by 79% over the same quarter 2020. That also put them above 2019 levels.

So the quarterly data points to a V-shaped recovery in hospitality in the two counties. At least for the snapshot taken in midyear of 2021. We won’t have access to the third quarter results for another two weeks and the fourth quarter results until mid-summer.

It is this writer’s hunch that the second half of 2021 was not nearly as robust as the second quarter for all industries impacted by tourism. First is mathematics: the drop in the third and fourth quarters of 2020 was not nearly as deep as in the second quarter – so there wasn’t as much ground to reclaim.

A second reason is the sensitivity of tourism-related businesses to the strength of the virus.

Case counts of Covid-19 in the two counties were much higher in the second half of 2021 than in the first half.

For the service portions of tourism – accommodations, food and beverage, as well as entertainment and creation – the high rates likely led to a renewed reluctance to travel and for residents to avail themselves of the offerings of these firms.

Is help on the way for the beleaguered hospitality industry in 2022? Absolutely. Will the rebound bring back activities to pre-pandemic levels? The odds point against this.

In its national outlook for 2022, the National Restaurant Association predicts that spending will slightly exceed 2019 levels. It reports, however, that 40% of its operators think that it will take a year more than another year to return to “normal.” That may well reflect the employment forecast: average national employment is seen to be half a million, or about 3%, below 2019 levels. Further, as we’ve observed locally, wages have pushed dramatic new highs.

And the accommodations industry? The “State of the Hotel Industry Report,” from the American Hotel and Lodging Association, paints an even greater delay.

“The travel outlook for 2022 is trending positively, but continuing volatility is expected, with full recovery years away,” it stated.

Leisure travel is seen as re-attaining 2019 levels, barring another omicron-like outbreak. Business travel, however, is still expected to be considerably below 2019 levels. Virtual work and meetings have had their impact.

It is unlikely that the greater Tri-Cities will escape these predicted trajectories.

That doesn’t mean, however, that 2022 will not bring revenues close to or exceeding 2019 levels in most industries that support tourism. That’s the benefit of a rapidly growing population.

On the other hand, among all Eastern Washington counties, the greater Tri-Cities has suffered the highest Covid-19 case rate, along with Yakima. As Washington state relaxes Covid-19 protocols, let’s hope that this distinction fades.

Patrick Jones is the executive director for Eastern Washington University’s Institute for Public Policy & Economic Analysis. Benton-Franklin Trends, the institute’s project, uses local, state and federal data to measure the local economic, educational and civic life of Benton and Franklin counties.

Local News Hospitality & Meetings

KEYWORDS march 2022