Home » Hurricane damage already affecting lumber prices, interest rates

Hurricane damage already affecting lumber prices, interest rates

October 12, 2017

By Dennis Gisi

Dennis Gisi,

Dennis Gisi,I am finishing up my month-end reports for my John L. Scott Offices for September with the television in my office talking about yet another tropical storm.

Last month it was the damage from hurricanes Harvey and Irma. They are truly catastrophic storms for all of us, but particularly those living in the region.

While the total cost of the two hurricanes is still unknown, AccuWeather projects the total will come in around $190 billion to $200 billion, compared to Hurricane Katrina at $160 billion in 2005.

Since hitting land on the Texas Coast on Aug. 25, lumber prices have gone from about $372 per MBF (one thousand board feet) to $405 MBF on Oct. 4 on the Chicago Mercantile Exchange.

The 30-year fixed rate loan rose from 3.74 percent to 4.11 percent during this same period.

While neither of these increases seem like a lot, it’s worth noting it’s an 8.9 percent increase for lumber and 10 percent increase for interest rates in a week.

Both are significant factors in the housing market.

Last October I wrote a column about whether the Tri-Cities was really a seller’s real estate market and I believe the answer is still yes, but I also wonder if the dynamics are changing.

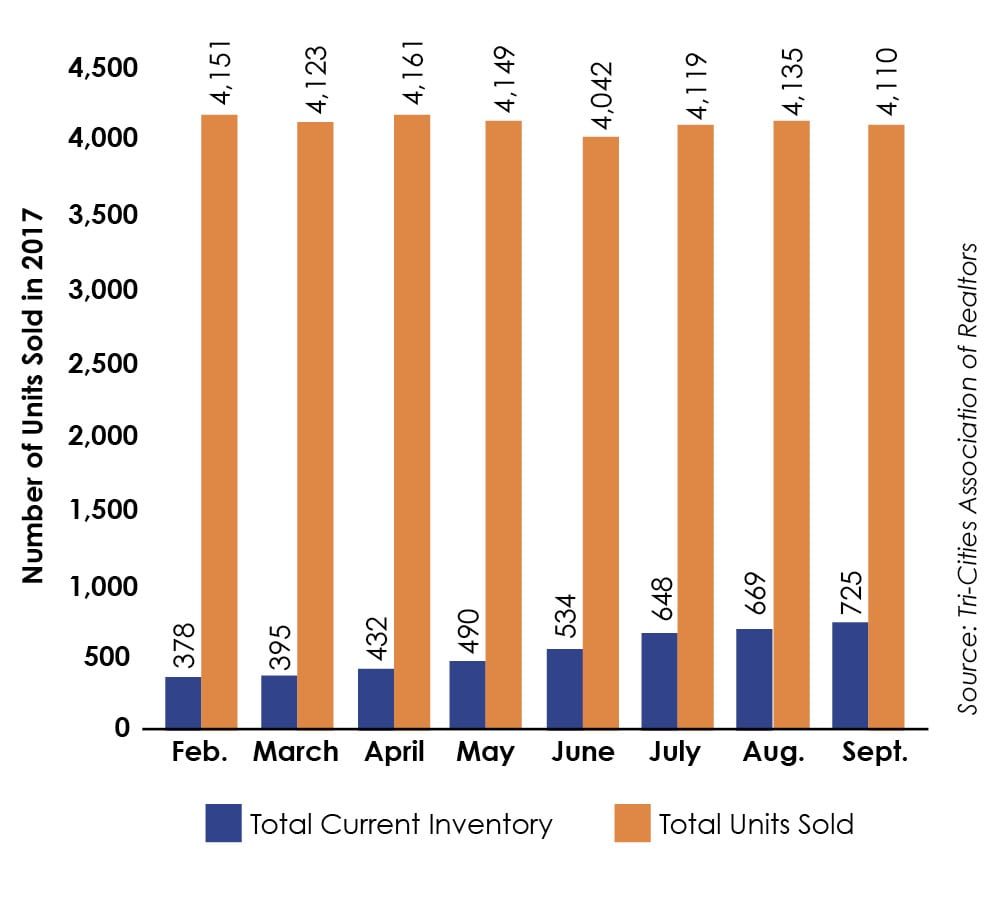

According to Tri-Cities Association of Realtors data for our area, home sales have been pretty steady.

The total number of units sold are calculated using a rolling 12-month period. For example, the 4,110 units sold in September is the number of homes sold from Oct. 1, 2016, through Sept. 30, 2017.

The total number of units sold are calculated using a rolling 12-month period. For example, the 4,110 units sold in September is the number of homes sold from Oct. 1, 2016, through Sept. 30, 2017.

However, look at the inventory numbers. The number of units in all price points has gone from 378 at the end of February 2017 to 725 units at the end of September 2017. This increase in inventory represents a 76.9 percent increase during the building season.

Let’s take a deeper dive into these numbers.

Pasco

Pasco recorded an 88 percent increase in inventory, with the biggest gain in the $200,000 to $250,000 price category.

Its inventory has been increasing since February.

The shortest supply is in the $150,000 to $200,000 category with only a two-week supply of homes.

We typically sell six homes a year in the $500,000 to $550,000 category and as of Sept. 30, we only had one listed for sale.

The most active sales category is between $200,000 to $250,000.

The greatest inventory surge was from $400,000 to $450,000 where inventory went up by seven homes.

Kennewick

Kennewick’s shortest supply is in the $150,000 to $200,000 category with only a two-week supply of homes.

The most active sale category is between $200,000 to $250,000.

The biggest jump in inventory is between $300,000 to $350,000 category.

Kennewick’s inventory has increased every month since March.

Richland

As with Kennewick and Pasco, Richland’s shortest supply is in the $150,000 to $200,000 price category with only a two-week supply of homes.

The most active sale category is between $250,000 to $300,000.

The biggest jump in inventory is between $350,000 to $400,000 price categories.

The most supply measured in the number of months is between $600,000 to $700,000.

West Richland

Interesting that West Richland has the shortest supply of homes between $300,000 to $350,000, a significantly higher price point than the other cities.

Sales are really pretty equal between $200,000 to $400,000 ranges.

What is the message in the numbers?

Sellers: This is still a seller’s market based on historically low inventory across the board and a robust employment market, which continues to bring new people to the area.

Buyers: They’ll be benefiting from more choices in homes that are available as builders work hard to provide supply to meet the demand for homes across the board.

Builders: They’ll have to keep an eye on expenses, particularly lumber and interest rates, as we move into winter, given the economic forces in the wake of the hurricanes to maintain their profit margins in the price points that are moving in their target markets.

When will this begin to turn? Well, that depends on job growth and the skills required by those new positions.

The topic of jobs is for food for thought for another column.

Rest assured, we are very fortunate and have been for the last few years to live in such a dynamic economic area as the Tri- Cities.

[panel title="About Dennis Gisi:" style="info"]

Dennis Gisi is the owner of John L. Scott in Pasco. Gisi is also the retired president, CEO and a former chairman of Bank Reale in Pasco.

Real Estate & Construction

KEYWORDS october 2017