Home » Tri-City manufacturing tilts toward agriculture, toward growth

Tri-City manufacturing tilts toward agriculture, toward growth

June 14, 2018

By D. Patrick Jones

The Tri-Cities prides itself on being a bit different from the rest of Eastern Washington. So is its manufacturing sector. Unlike most metro areas this side of the state, manufacturing here doesn’t loom among the top five sectors by employment. As Benton Franklin Trends indicator 3.3.4 shows, the largest employing sectors in the Tri-Cities are, in order: government, health care, agriculture, retail and waste services. In 2016, manufacturing ranked as the eighth largest employing sector.

Yet, this ranking hardly means manufacturing is unimportant to the Tri-Cities’ economy. It just has a different mix. For one, manufacturing here is dominated by the processing of agricultural products. In the case of Benton County, food and beverage manufacturing claimed slightly over 50 percent of all manufacturing jobs in 2016. In Franklin County, manufacturing jobs are even more tilted toward agricultural processing, with 75 percent accounted for by those two sub-sectors.

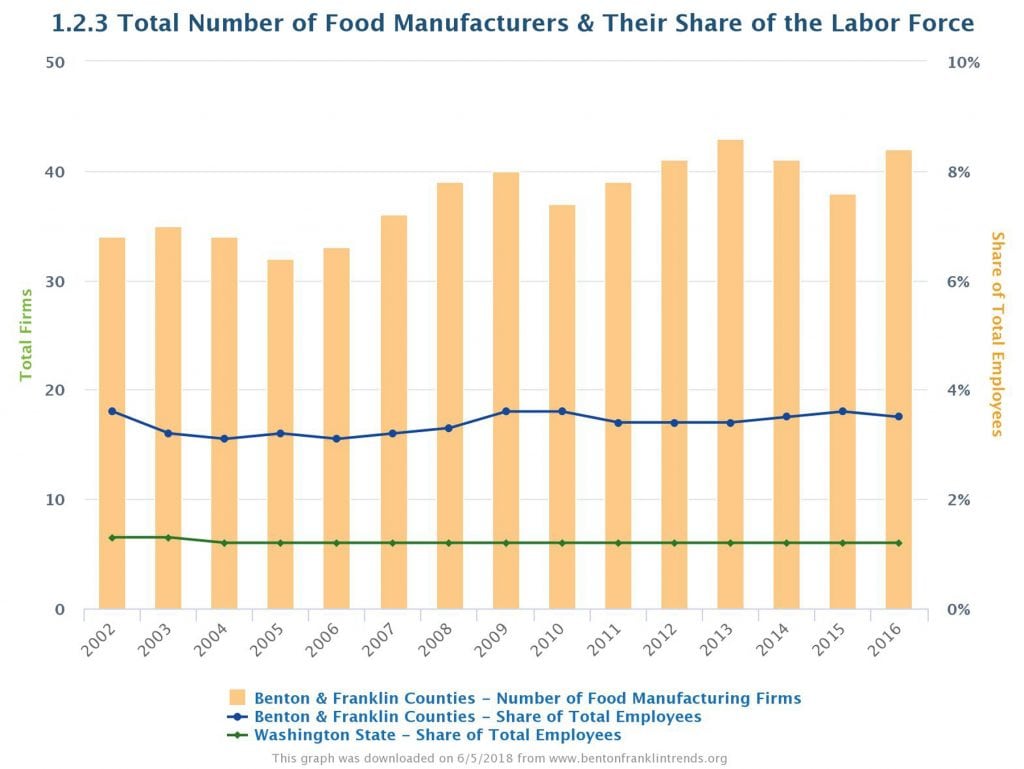

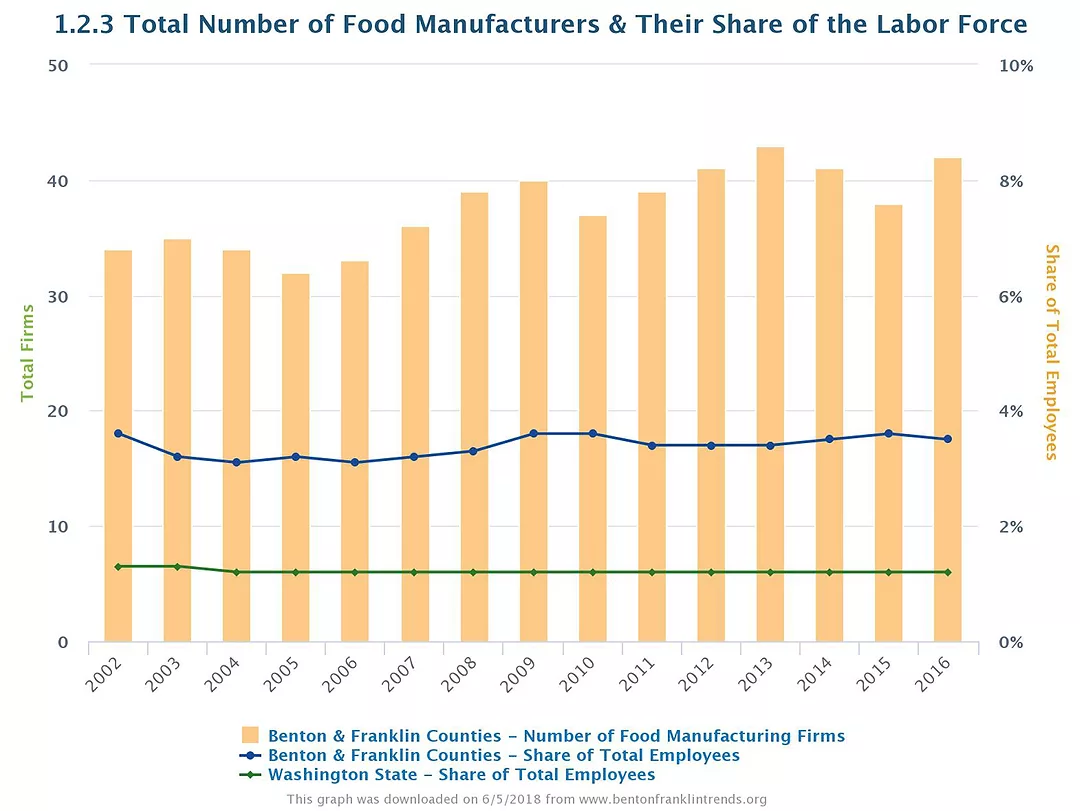

As a consequence, the share of agricultural manufacturing among all jobs is the highest here of all Eastern Washington metro areas, including Yakima. One can catch a glimpse of the role that agricultural manufacturing plays in the two counties by considering considering Benton Franklin Trends indicator 1.2.3 (shown below). The area has consistently shown that these jobs are three times as frequent as statewide.

There are, to be sure, other manufacturing sub-sectors worth noting in the regional economy. In Benton County, primary metals manufacturing, as well as computer and electronic production, stand out. In Franklin County, non-metallic mineral products (cement, bricks) make a decent job showing. Still the manufacturing headline in the two counties belongs to agriculture.

Between the two counties, the composition of agricultural processing differs quite a bit. For Franklin County, nearly all of the jobs can be found in food processing. This probably doesn’t surprise anyone who travels up and down Highway 395. Benton County, in contrast, shows food processing as the larger activity, but beverage, largely wine, production is now running a relatively close second.

In fact, the number of jobs in beverage production in Benton County averaged 1,263 in 2016. This count dwarfs those of surrounding counties, more than doubling the nearest one, Walla Walla. And this has been one of the county’s growth industries: since 2005, the labor force involved in beverage production has climbed by more than three-fold. No other sub-sector in the county has experienced that kind of growth. Clearly, wine matters for Benton County. In contrast, Franklin County’ agricultural manufacturing mix shows very little wine-making.

Manufacturing often leads to some exports. Shipping goods abroad is regarded as a signature achievement for a regional economy. The ability for local companies to sell their goods and services to consumers around the world implies that they possess a unique product, or one that can’t be filled completely by local suppliers. In the Tri-Cities, agricultural manufactured exports serve this role, as Benton Franklin Trends indicator 3.2.6 depicts. For the most recently reported year, 2016, manufactured agricultural exports from the metro area amounted to $331 million. That amount represented half of the value of all exports that year, with crop production coming in a distant second.

What will future years hold for agricultural processing and beverage manufacturing here? The quick answer would be continued robust growth. For example, while agricultural processing jobs in Benton County have been relatively flat since 2005, they have doubled in Franklin County over the same period. Domestically, national population and income growth should increase demand for french fries, frozen vegetables and wine. The real unknown lies in exports.

The Trends don’t (and cannot) track the share of agricultural processing sales by product type that are export-bound. It is likely that processed potatoes have led, followed by other frozen vegetables, followed by wine. In the recent four years, exports of processed potatoes from Washington have hovered around $750 million. While much smaller, the value of the metro area wine exports has likely grown, if local exports mirror national trends.

But a quick answer about exports may be incorrect, given the looming uncertainty of U.S. trade agreements with key countries. According to a recent U.S. Department of Agriculture report, frozen potato products have tripled in value since 2004. The biggest buyers have been Japan, Canada, Mexico, China and South Korea. These are all countries now in the crosshairs of the current administration’s tough trade policies. While we haven’t read of possible tit-for-tat retaliation by these countries toward Washington state products, we cannot rule that out.

One might argue that the Tri-Cities would be wise to diversify its manufacturing sector, so most of its eggs aren’t in one basket. Doing that raises the question: into what other kinds of manufactured products? Can the existing manufacturing companies that are not ag-based grow at a faster pace than to-date? Undoubtedly, a topic for a future column. For now, and for the foreseeable future, agriculture rules.

Patrick Jones is the executive director for Eastern Washington University’s Institute for Public Policy & Economic Analysis. The Benton-Franklin Trends, the institute’s project, uses local, state and federal data to measure the local economic, educational and civic life of Benton and Franklin counties.

Local News Manufacturing

KEYWORDS june 2018