Home » Benton-Franklin retail sales reach $5.8 billion in 2018

Benton-Franklin retail sales reach $5.8 billion in 2018

June 13, 2019

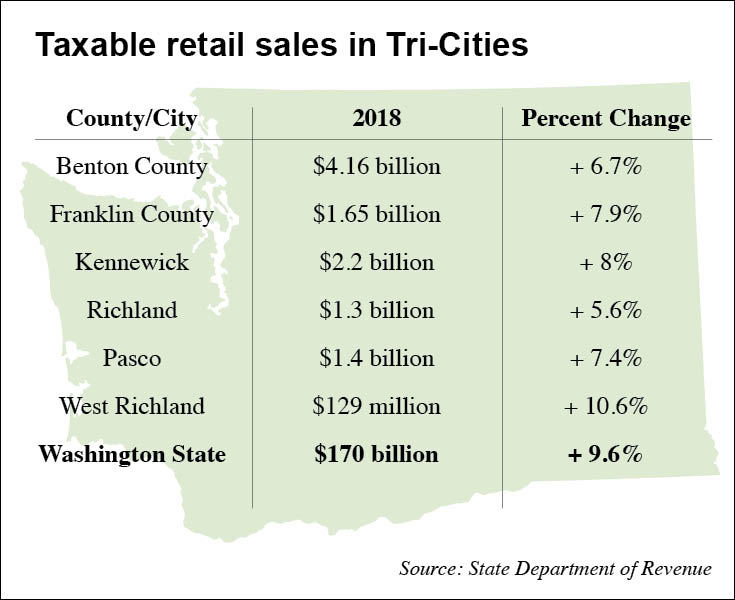

Benton and Franklin counties recorded $5.8 billion in taxable retail sales in 2018, a 7 percent gain over the previous year.

Franklin County recorded $1.65 billion in 2018, a 7.9 percent increase over the previous year, and Benton County $4.16 billion, a 6.7 percent increase.

Continued gains in construction and auto sales sent statewide taxable retail sales to a record $170 billion in 2018, a 9.6 percent gain over 2017.

Taxable retail sales are transactions subject to the retail sales tax, including sales by retailers, the construction industry, manufacturing and other sectors. Retail trade includes sales of items such as clothing, furniture and automobiles, but excludes other industries, such as services and construction.

Statewide, retail trade, a subset of all taxable retail sales in the state, increased by 7.2 percent in 2018 over 2017 to a total of $71.5 billion.

The data is part of an annual report recently released by the state Department of Revenue. The agency reports on a quarterly and annual basis the total taxable retail sales reported by businesses on their Washington tax returns. The agency uses Census Bureau classifications to report the sales revenues by sector.

Some statewide highlights of 2018 taxable retail and retail trade sales:

- Construction rose 14 percent to $35.2 billion.

- Taxable retail sales reported by new and used auto dealers increased 2.3 percent to $13.9 billion.

- Sales of building materials, garden equipment and supplies rose 8 percent to $7.5 billion.

- Electronic and appliance stores increased by 12.6 percent to $4.3 billion.

Local News

KEYWORDS june 2019