Home » Retail sector ranks as fourth largest employer in Tri-Cities

Retail sector ranks as fourth largest employer in Tri-Cities

November 14, 2019

By D. Patrick Jones

The sale of goods is big business in the greater Tri-Cities. As Benton-Franklin Trends data reveals, the retail sector has consistently ranked as the fourth largest employer in the area’s workforce. Over the course of the past 15 years, local retailers’ share of the workforce has stayed constant at around 10.5 percent. This steady performance stands in contrast to other Eastern Washington metros, where retailing has seen its share diminish over the same period.

D. Patrick Jones,

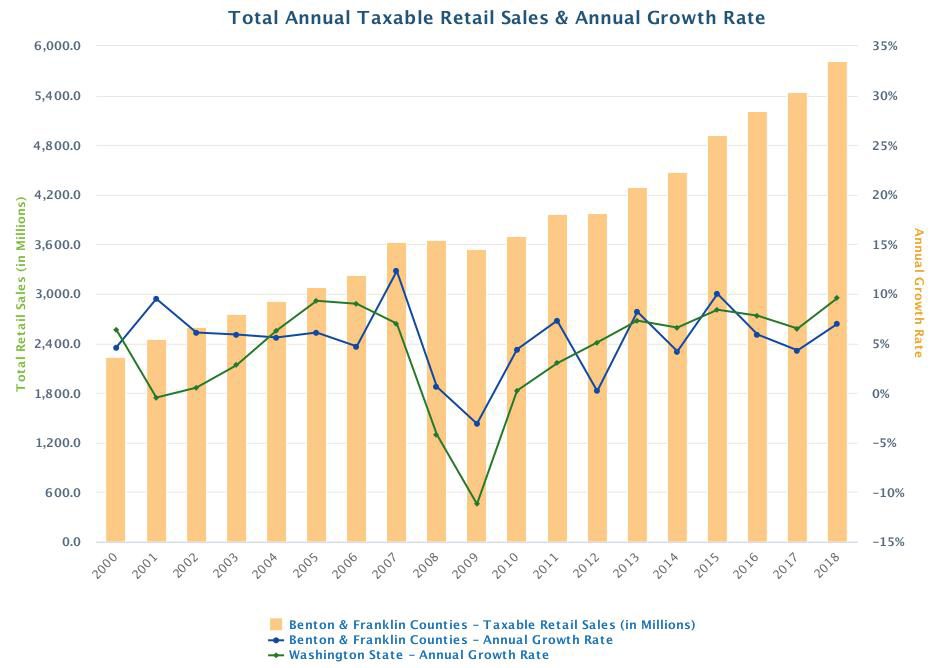

D. Patrick Jones,The two counties have been on a taxable retail sales roll for several years, as the Trends graph depicts. In 2009, total taxable retail sales amounted to $3.54 billion. Ten years later, sales were $5.82 billion. That’s a cumulative gain of 64 percent to 2018, ranking second among all Eastern Washington metros. The increase was slightly behind the state’s cumulative gain of 69 percent. Had not the growth rate dropped over the past three years, taxable retail sales growth in the greater Tri-City area would have exceeded that of Washington and may have approached the rate of the east-side leader, the greater Wenatchee area.

We now find ourselves in the fourth quarter of the year, the all important three months in a retailer’s calendar. Much of the success of 2019 will depend on the current selling period. At this point, a local forecast is pretty speculative since we enjoy only the data on the first quarter of the year.

A national forecast might guide us. The National Retail Federation recently issued its outlook for the last two months of the calendar year. Its economists estimate a gain of 3.8 percent to 4.2 percent over the same two months of last year. Given the NRF’s membership, this projection excludes sales at automobile dealerships and restaurants. In 2018, retail sales, so defined, climbed 2.9 percent during the two months. In the Tri-Cities, fourth quarter year-over-year growth was considerably higher, at 7.8 percent, according to Trends data.

How has retail increased so strongly in the two counties—last holiday period and over the past several years? Well, it’s a little complicated. The largest contributor over the past five years (2014-18) was, in fact, construction. The sector making the second largest contribution was restaurants. The third largest: private education and health care. It is not until the fourth largest source of growth, motor vehicles and parts, that we observe a sector that is regarded as retail.

The general category in which motor vehicles and parts can be found, “retail trade,” currently makes up only half of all taxable retail sales in both counties. Such is the tax structure of Washington state.

So, if “retail trade” is responsible for only half of this measure, and if the local forecast follows the NRF projection, that doesn’t follow that retail sales collection can be expected to rise 4 percent in this quarter. Much will depend on the pace of construction and the success of restaurants during the same period.

To this observer, a mid-single digit increase for retail trade growth in the fourth quarter might be a bit optimistic. For one, the largest contributor, motor vehicle and parts, has not been enjoying robust sales over the past two years. In 2018, the annual increase was a mere 0.4 percent. While the first quarter doesn’t appear to be a greater predictor of sales later in the year, motor vehicle and parts sales in the first quarter of this year were down 10 percent in the two counties. Noteworthy is that the National Automobile Dealers Association forecasted late last year a decline of 1.1 percent of sales of cars and light trucks nationally in 2019.

In the first quarter, growth in restaurant sales were essentially the same as in 2018. The construction sector, however, showed substantial year-over-year growth, at 13 percent. In contrast, retail trade sales were up 2.4 percent while total taxable retail sales were up only 2 percent.

In the final analysis, whether growth in the two counties’ “taxable economy” hits mid-single- or high-single-digit growth during the final quarter of this year will depend on the pace of construction and the local appetites at restaurants and drinking places. Santa of the Tri-Cities should still be busy, distributing more “stuff” than last year. If you see him often with a hammer in hand or delivering a plate a food, then you’ll have a good idea that from a taxable sales perspective, it was a good holiday season.

Patrick Jones is the executive director for Eastern Washington University’s Institute for Public Policy & Economic Analysis. Benton-Franklin Trends, the institute’s project, uses local, state and federal data to measure the local economic, educational and civic life of Benton and Franklin counties.

Local News Retail

KEYWORDS november 2019