Home » Top Tri-City jobs vary wildly by county

Top Tri-City jobs vary wildly by county

November 14, 2019

In the Tri-City area, retail jobs are among the top five most in demand.

That’s according to the state’s recently released Employment Security Department’s employer demand reports.

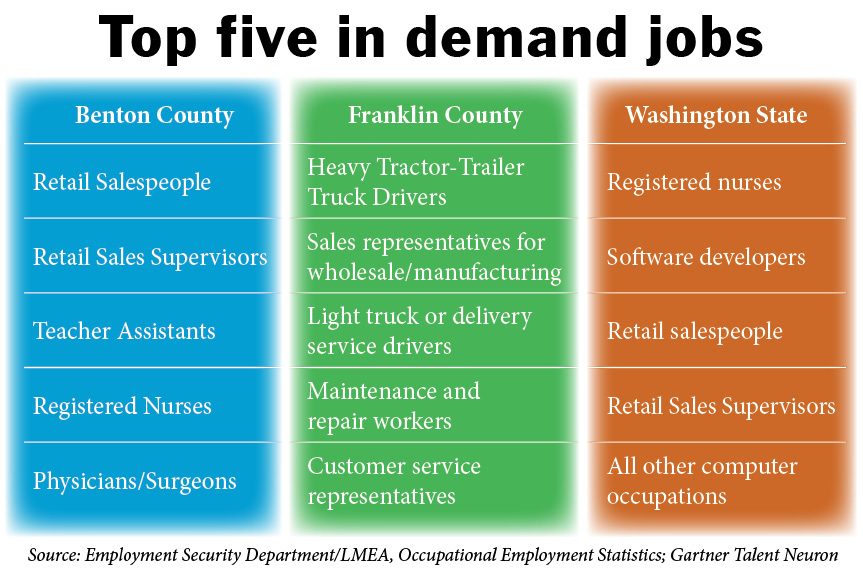

Retail salespeople, retail sales supervisors, registered nurses, physicians and surgeons, and teacher assistants were the top five jobs advertised online in August in Benton County.

There were 144 job postings for retail salespersons and 121 for retail supervisor positions.

Benton County’s top employers, based on online ads from June to September, were Pacific Northwest National Laboratory (526 jobs), Kadlec (399 jobs), Kennewick School District (376 jobs), AECOM (141 jobs) and CityState LLC (132 jobs).

In Franklin County, the top five jobs advertised online in August were for heavy and tractor-trailer truck drivers, light truck or delivery services drivers, customer service representatives, sales representatives for wholesale and manufacturing jobs, and maintenance and repair workers. Jobs advertised in those five categories totaled 177.

Franklin County’s top employers, based on online ads from June to September, were the state of Washington (83 jobs), J.R. Simplot Co. (53 jobs), Columbia Basin College (45 jobs), Lowe’s (42 jobs) and Assurance (41 jobs).

Statewide, jobs for registered nurses, software developers, retail salespersons, retail sales supervisors and all other computer occupations were the top five positions advertised online in August.

The state’s top employers, based on online ads from June to September, were Providence Health & Services (11,083 jobs), Amazon (8,602 jobs), the state of Washington (8,592 jobs), University of Washington (3,812 jobs) and PeaceHealth (3,458 jobs).

The state’s reports are based on the Gartner TalentNeuron data series, which provides real-time labor demand gathered from online job ads.

Across the state, total nonfarm payroll employment rose 1,700 (seasonally adjusted) in September, which was 3,100 less than expected in the September forecast. However, the difference was mostly due to government employment, which declined by 1,900.

“We believe the drop was due to a seasonal adjustment problem with state government education, which artificially increased the level of employment the month before,” according to the State Budget Outlook Work Group’s Nov. 4 report to the Economic and Revenue Forecast Council.

Private services-providing sectors added 2,900 jobs in September. The manufacturing sector added 400 jobs, of which 200 were aerospace jobs. The construction sector added 200 jobs in September.

The number of Washington workers —about 9,000—receiving layoff notices this year is the highest since 2009, according to the Economic and Revenue Forecast Council.

Washington’s unemployment rate remained at 4.6 percent in September for a fifth consecutive month. The state’s unemployment rate remains near its all-time low of 4.4 percent last reached in October 2018.

Benton County’s unemployment rate in September was 4.6 percent; Franklin County’s was 4.9 percent.

“We expect 1.9 percent Washington employment growth this year, which is the same rate expected in the September forecast. As in September, we expect growth to decelerate. We expect employment growth to average 1.2 percent per year in 2020 through 2023, which is also unchanged since September. Our forecast for nominal personal income growth this year is 5.2 percent, down from 5.6 percent in the September forecast,” the report said.

The U.S. economy added 128,000 net new jobs in October. Employment data for August and September were revised up by 95,000 jobs, according to the report. Sectors with notable employment gains in October included accommodation and food services (+53,000), social assistance (+20,000), professional and technical services (+16,000) and financial activities (+16,000).

Sectors with net employment declines in October included motor vehicle and parts manufacturing (-42,000; this reflects the now-resolved General Motors strike), federal government (-17,000; largely reflecting layoffs of temporary Census workers), performing arts and spectator sports (-10,000), temporary employment services (-8,000), clothing and accessories stores (-8,000) and motion picture and sound recording industries (-6,000).

Local News Labor & Employment

KEYWORDS november 2019