Home » Expect changes to real estate excise taxes in coming year

Expect changes to real estate excise taxes in coming year

December 13, 2019

By Dennis Gisi

John L. Scott Real Estate

I was amazed at the number of items we voted to maintain or repeal that were listed on the Nov. 5 ballot that contained the phrase, “without a vote of the people.”

I

am not sure why I am surprised. I am learning a lot about how things are done

in Olympia, and I thought I would share a few as they relate to real estate,

taxes, housing shortages, planning issues, affordable housing and the like.

There

is a saying that goes something like, “I missed the meeting and got appointed.”

Well, evidently, I missed two of those meetings and got myself appointed to the

Washington Association of Realtors, or WAR, Legislative Steering Committee and

the Finance Committee. I will keep my comments focused on some of the

legislative issues. I also will say that these comments are my interpretation

of what has or is happening in Olympia.

Let

me start with my first meeting during the 2019 legislative session.

The

Legislature reviewed a budget proposal for $44.6 billion containing a $4

billion surplus. So why is the governor looking at a minimum of 20 percent

increase in taxes across the board? There are three main reasons:

1.

Our public education system is broke. The culprits are the McCleary decision

and the unions.

2.

The governor wants to reduce or remove the deficit funding for the Public

Employee Retirement System, or PERS.

3.

The governor had promised annual 3 percent raises for the next two years to all

Washington state public employees and wants to keep this promise.

The

result of these points above would equal a large future deficit in the budget.

Therefore, the governor wants those addressed before he leaves office. At one

point during the session, the governor proposed a general 20 percent increase

to all potential sources of revenues.

As

the 2019 session moved on, the targeted funding sources, which applied to the

real estate industry, became:

•

Washington expects to collect more real estate excise taxes in the coming year, but the vast majority of Tri-City home sellers will see the state tax go down.

The 2019 Legislature lowered the excise tax to 1.1 percent for properties that sell for $500,000 or less, from the old rate of 1.28 percent. Properties that sell for $500,000.01 to $1.5 million will continue to be taxed at the 1.28 percent rate.

•

The proposal is increasing the tax from 1.5 percent to 2.5 percent, raising an

estimated $2.5 billion for the general fund.

The

win in this case was negotiated with the help of the Washington Association of

Realtors and came as follows:

1.

Real Estate Excise Tax (House Bill 1219): Real estate excise tax, or REET, is a tax on

the sale of real estate. The real estate excise tax is typically paid by the

seller of the property, although the buyer is liable for the tax if it is not

paid. The tax applies to the seller. The tax also applies to transfers of

controlling interests (50 percent or more) in entities that own property in the

state.

Changes

are coming to REET effective Jan. 1. Engrossed Substitute Senate Bill

5998 made changes to the real estate excise tax program. Some of these

changes include:

•

A graduated state REET rate structure for sales of real property. An exception

is agricultural land/timberland which is excluded from the new rate

structure and will continue to have a state REET rate of 1.28 percent.

•

Updates for controlling interest transfers (50 percent or more change of

ownership in an entity that owns real property). It expands the transfer period

from 12 months to 36 months and changes the reporting requirements during the

annual corporate renewal cycle to disclose any transfers of 16 percent or more.

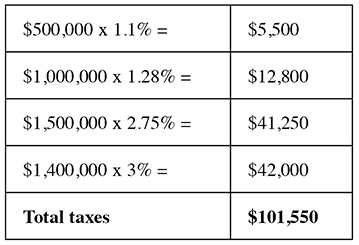

Here’s

what the graduated REET structure will look like, according to data from the

Washington State Dept. of Revenue. Please note these rates are for the state of

Washington. Local jurisdictions can add to this amount.

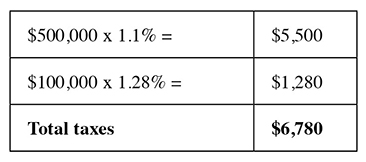

Example

A: If the total sale price is $600,000, then the first $500,000 is taxed at 1.1

percent. The remaining $100,000 is taxed at 1.28 percent.

Example

B: If the total sale price is $4.4 million, then the first $500,000 is taxed at

1.1 percent. The next $1 million is taxed at 1.28 percent. The next $1.5

million is taxed at 2.75 percent and the final $1.4 million is taxed at 3

percent.

2.

The capital gain tax

was eventually defeated. To accommodate the affordable housing issues, the

proposal was to institute a 7 percent to 13 percent capital gains tax on real

estate. On the residential side, the scale would look something like this based

on the value of the home.

3.

Enormous housing policy

session. Final

proposals on the study regarding the Growth Management Act are being completed

and we should see potential proposals or changes over the next couple of years,

particularly as they relate to affordable housing and homelessness.

4.

Affordable housing:

•

Fixing the Condominium Liability Law (Senate Bill 5334), making it harder for

class-action attorneys to file lawsuits against developers that result in

delaying projects for years.

•

Gov. Jay Inslee will allow local legislative bodies to delegate final plat

approval to “an established planning commission or agency, or to such other

administrative personnel.” The goal of the bill is to provide local

jurisdictions with additional final plat approval options that could bring housing

to the market faster and reduce risks and costs to homebuilders while retaining

the basic platting framework. The city of Walla Walla already implemented a

more streamlined process on small plats.

As

we prepare for the 2020 legislative session, we do not expect any major events

or changes happening as it is a short session. The most that might happen is a

tweaking or clarification of statements regarding last year’s bills. It will be

interesting to watch what potential impact these tax and rule changes may have

on the local as well as statewide economies.

Dennis D. Gisi is the broker owner of John L. Scott Real Estate with offices in Pasco, Walla Walla, and Milton-Freewater and Hermiston Oregon. He serves as a member of the Washington Association of Realtors – Legislative Steering and Finance committees.

Editor’s note: This story was modified on Dec. 30 to reflect that most Tri-City property sellers will see the state portion of the real estate excise tax drop or remain unchanged in 2020.

Real Estate & Construction

KEYWORDS december 2019