STCU hits $5 billion, eyes more branches in the Tri-Cities

Five years after it expanded into the Tri-Cities, STCU reports it has hit important milestones on its way to becoming a $5 billion institution, making it Washington’s third largest credit union after Boeing Employees and Gesa.

STCU, for Spokane Teachers Credit Union, has more than 250,000 members and 875 employees following its latest expansion, a deal with Banner Bank that converted three branches in Stevens County and one in Hayden, Idaho, to the STCU brand.

The Banner deal added 8,000 members and $200 million in total deposits.

It follows a string of moves to expand the business that began in 2018, when STCU announced it was entering the Tri-Cities. It was STCU’s first foray beyond its base within a 25-mile radius in the Spokane-North Idaho area.

It opened its Kennewick branch in 2018, its Richland one in 2019 and Pasco in 2020, which is the same year it opened a commercial banking office on Tucannon Street, near Gage Boulevard.

It had about 2,500 local members when it moved to the Tri-Cities and now counts about 6,000 in the area.

With the move, it extended its reach to 200 miles, a geography that extends from Wenatchee to Missoula.

Why growth matters

Ezra Eckhardt, STCU’s president and CEO, said it continues to search communities in that area to add to its list.

It plans to break ground in 2023 on a branch in Moses Lake, where it has 3,000 members and a branch it acquired in 2020 in Coulee City. In Othello, where it leases space, it plans to build a new branch about two blocks away.

Eckhardt isn’t ruling out entering the Montana market to serve Missoula.

The Tri-Cities could see two more locations. Eckhardt it probably will not happen for at least two years.

STCU casts its growth as a way to build economies of scale while providing banking services to rural markets left behind as big banks consolidate in larger markets, closing or selling their far-flung branches.

There are a few recent examples in the Tri-Cities: U.S. Bank closed its downtown Kennewick branch and cut Thursday hours at its Edison Street branch. Bank of America closed its downtown Pasco branch. Banner Bank and HomeStreet Bank have closed or sold local branches.

While Tri-Citians have plenty of choices, Eckhardt said it’s a pattern that can leave smaller communities across Eastern Washington and Northern Idaho without a local financial institution.

“We know, there’s still people who live in those towns,” he said. “They need checking and savings and home refis and car loans.”

Mobile vs. branch

He acknowledged it is expensive to build new branches or remodel existing buildings – $3.5 million for the first Kennewick office – but physical branches are important to customers and fit into its business model, he said.

“Go to Othello and look at the line out the door, or to the main branch in Spokane on the first Monday or last Friday. We have lines out the door,” he said.

STCU estimates 150,000 members use a branch at least once a month.

He said 60% of STCU members have registered to use its mobile banking app and 40% use it.

That runs somewhat behind national trends. In 2021, Forbes magazine reported that 76% of participants in its weekly consumer confidence survey had used their primary bank’s mobile app within the past year.

He’s proud of the STCU mobile app but said it’s important to offer customers choices.

“We want to meet the members where they want to be met.”

Credit unions vs. banks

Credit unions began as cooperatives based on common workplaces or geography. A change in the law means most credit unions can serve just about anyone with a personal, professional or spiritual home in the state of Washington.

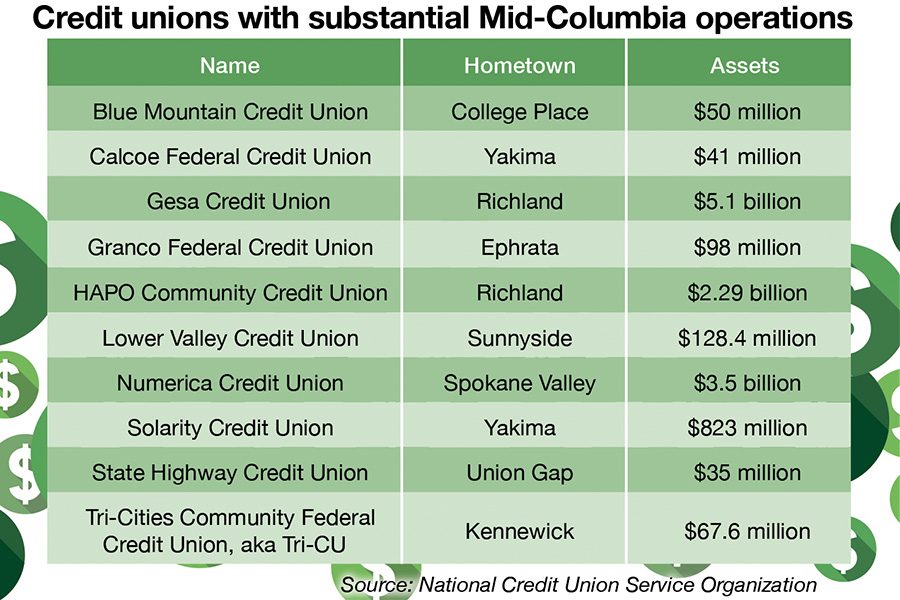

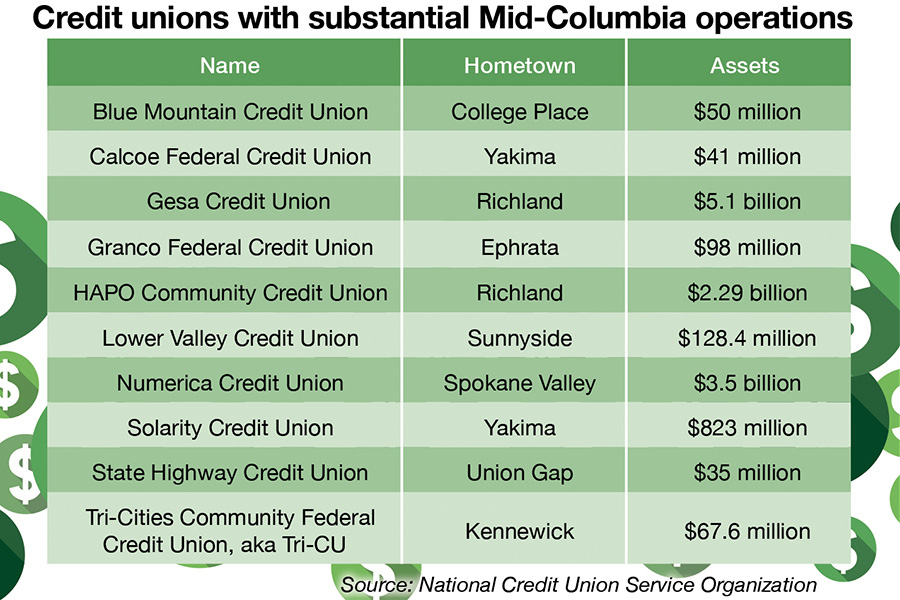

The open-door policy has led to a long list of credit unions. Washington is home to 84 credit unions, including 49 that are chartered by the state, according to the state Department of Financial Institutions and the National Credit Union Service Organization.

They range in size from the massive Boeing Employees Credit Union (aka BECU), with $30.4 billion in assets and nearly 1.4 million members, to smaller operators such as Tri-Cities Community Federal Credit Union in Kennewick, which operates as Tri-CU.

Richland-based Gesa Credit Union is Washington’s second largest credit union with $5.1 billion in assets and nearly 275,000 members after its 2019 merger with Seattle-based Inspirus. HAPO Credit Union, also based in Richland, is the ninth largest, with $2.3 billion in assets and 200,000 members.

While credit unions cooperate and share best practices, Eckhardt scoffs at the idea their tax-free status confers an unfair advantage over for-profit banks.

It is “farcical,” he said.

“Banks have a substantial competitive advantage in terms of their capital structure. They can raise debt in a way credit unions cannot. They can raise equity in a way credit unions cannot,” he said.

It cited Credit Union National Association research that indicates Washington households save an average of $181 in 2019 by banking at credit unions.

Economic jitters

Eckhardt said lending remained strong in the first half of 2022, even as inflationary fears took hold and affected lending and consumer spending.

STCU originated $500 million in new loans, a substantial gain on an annualized basis. Individual consumer loans, commercial loans and some home equity loans remained strong, but mortgage lending is falling after the Federal Reserve completed four interest rate hikes.

The interest rate for a conventional 30-year mortgage in Washington stood at 5.5% in late July.

“Refinances evaporated three months ago,” he said. He predicts new loans will dry up in August as interest hikes continue.

The Consumer Price Index rose at an annualized rate of 9.1% in June, according to figures released in July by the U.S. Bureau of Labor Statistics.

The same pressures on interest rates are driving a reversal in deposits. STCU said deposits grew 22% in 2020 and 24% in 2021. That has tapered off as members spend more on food, fuel and housing, the biggest contributors to inflation.

“We didn’t see members spend a lot of the stimulus. They saved it. But now they’re spending it.”