Home » Housing market slowdown means more inventory for buyers

Housing market slowdown means more inventory for buyers

December 14, 2022

Brett Lott’s entry in the 2022 Parade of Homes was everything a move-up buyer in the Tri-Cities could want.

Upscale south Richland address? Check. Comfortable home office? Check. Well-appointed kitchen overlooking an elegant living room with coffered ceiling and a custom-built mantle over the fireplace? Check, check and check.

But four months after the Home Builders Association of Tri-Cities held its annual new home showcase, the entry by Brett Lott Homes was on the market, with an asking price of $730,000.

Lott was optimistic enough that his company continues to build homes. But its unsold house was symbolic of a slowdown in home sales in the Tri-Cities, particularly at the upper end of the market.

“It’s a completely different market than it was four months ago,” said Ron Almberg, designated broker with Keller Williams Tri-Cities and the 2022 president of the Tri-City Association of Realtors. “It’s like someone slammed on the brakes.”

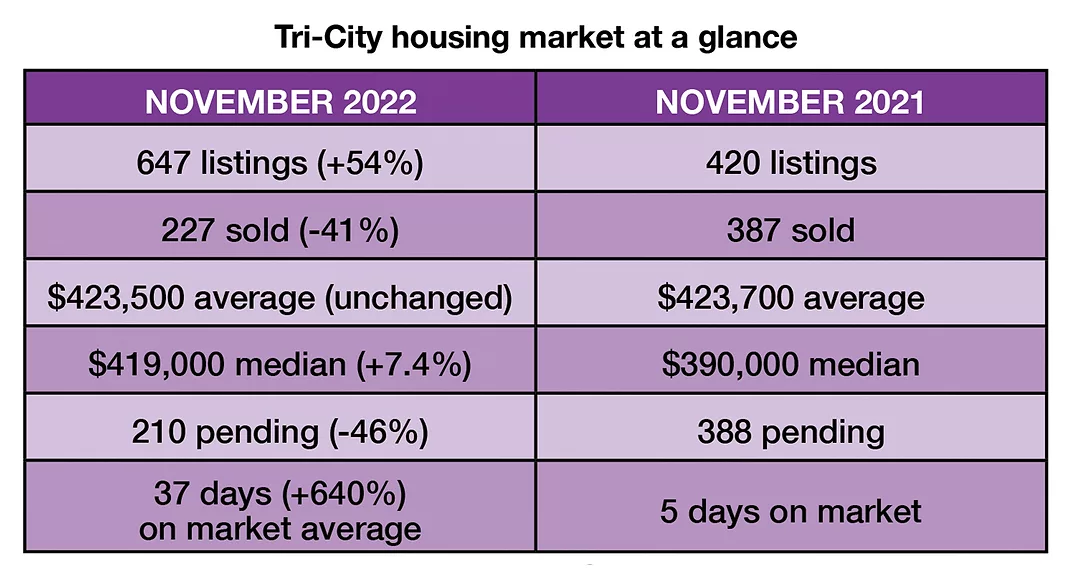

The number of homes listed on the market rose by 54% in November, while the number of closed and pending sales fell 41% and 46%, respectively, compared to the same month in 2021, according to the figures released Dec. 13 by the Realtors association.

Local figures echo the national trend. The National Association of Realtors reported a 37% decline in its pending home sales index for October. It was sharper in the West at 47%. “Pending” sales are homes with a signed contract that have not closed.

The market has slowed, but the situation is not dire. The economic engines that drive the Tri-Cities – federal spending at Hanford, agriculture and food processing – remain intact and relatively recession-proof.

Dave Retter, president of Retter & Company | Sotheby’s International Realty, the market’s largest real estate firm, sees little to suggest demand for housing to buy or rent will shrink.

There were 1,700 jobs on offer during a recent Hanford job fair. Reser’s Fine Foods upgraded to a larger food processing plant in Pasco. Darigold Inc. broke ground on a $600-plus million plant that will employ hundreds.

Local Bounti Inc. restarted construction on its commercial greenhouse in Pasco and a pair of distribution warehouses stand ready for Amazon Inc.

“I’m not aware of any negative news, employment wise,” Retter said.

Interest rates to blame?

The traditional holiday slowdown partly explains the home sale activity, which dropped to 227 sold and 210 pending in November. Six – and counting – interest rate hikes by the Federal Reserve to combat inflation pushed the average 30-year mortgage interest rate to the 6.6%-7% range, from about 3.2% in January.

The average dipped to 6.49% on Dec. 1, adding more uncertainty for buyers trying to pick the moment to lock in the lowest rate.

“All of us are convinced it is interest rates,” Almberg said.

Buyers, he said, are wary of locking into 7% mortgages for decades to come, though industry veterans note that 7% is the long-term average and the ultra-low rates that buyers expect are a more recent phenomenon.

Higher interest rates coupled with home price appreciation added $1,000 to the monthly mortgage payment for a buyer who financed a typical home in October versus January, according to Freddie Mac, the federally controlled entity that provides liquidity to the home lending market by purchasing mortgages and packaging them for investors.

Freddie Mac based its estimate on a buyer financing a $400,000 mortgage in January 2022 and a $430,000 for the same theoretical home in October, reflecting home price increase. The higher price and higher interest drove the monthly payment to $2,700, from $1,700, it said.

That’s a realistic scenario for Tri-City buyers.

The average home sold for $423,500 in November, unchanged from a year ago. The median was $392,000.

In a sign of buyer unease, it took 37 days on average to sell a home, a lifetime compared to the five days a year earlier.

Good news for buyers, agents

While buyers contend with the higher cost of borrowing, they at least have more to choose from.

The number of homes on the market rose to 647 in November, the most of any month since September 2019, when there were 674. The Tri-City market is considered balanced with 1,200 for sale, so the shortage is real.

But momentum has shifted toward buyers, Almberg said.

“We just got out of two- or two-and-a-half years of sellers asking for everything and offering nothing. Now, buyers are asking for repairs and seller’s concessions and sellers paying closing costs.”

Almberg and Retter both said slowdowns restore a sense of normalcy for agents who spent the past two plus years scrambling to keep up with the fast pace.

Almberg laughed when he recently overheard younger agents lamenting that they had to organize open houses to bring in buyers – a routine selling strategy when markets are in balance. It is unclear if the slowdown will affect the 1,200 or so licensed agents working in the Tri-Cities.

Local Realtors renew their membership in the Realtors association in December and January, so it will be several months before it is clear how many continue in the profession.

Almberg said the pause means agents can be thoughtful about their business instead of scrambling to react.

“They need to really dig into the activities that are going to build their real estate business,” he said. “Most experienced agents I talk to are liking the shift in the market. None of us really liked the chaos of the last couple of years.”

Green shoots of spring

Market leaders anticipate a spring thaw on the theory the market will adapt to the new reality and lenders dust off products such buydowns and adjustable-rate mortgages.

“I think the lending side is trying to play catchup,” Almberg said.

Retter said buyers are still out there, just holding back and waiting for the market to stabilize.

“Four months ago, we had 10 offers per house. Those people have not gone away,” he said.

Now, Retter said, buyers are pausing, hoping interest rates will fall back to the 5% range as the feds ease up on future rate moves and lenders narrow the spread between the federal rate and what they charged.

Veteran real estate professionals will persist, he said.

“Our veterans recognize and adapt to the changes and stay true to the fundamentals, like calling people back and understanding the business,” he said. “Real estate matters.”

Real Estate & Construction

KEYWORDS december 2022