Home » Food and beverage processing dominates Tri-City manufacturing sector

Food and beverage processing dominates Tri-City manufacturing sector

June 13, 2023

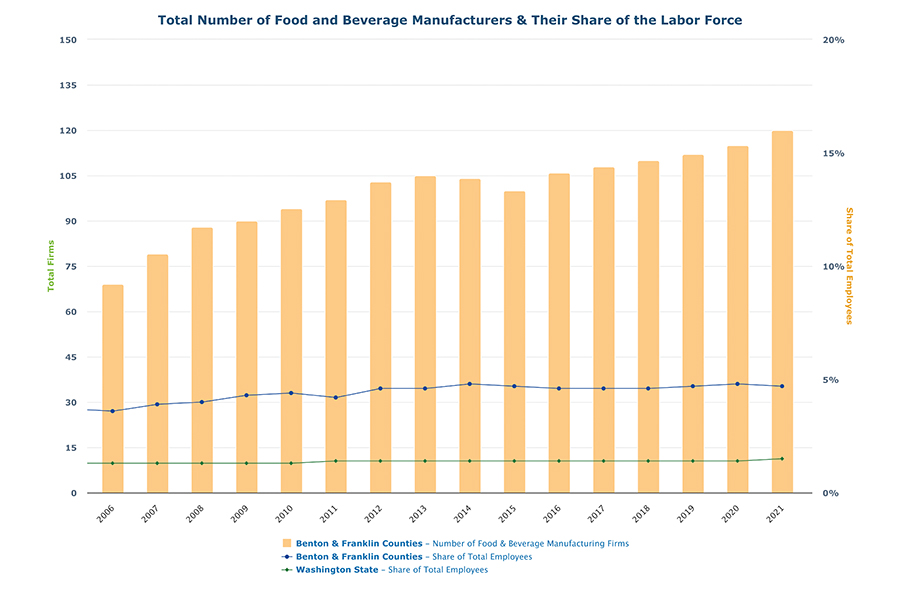

Manufacturing in the greater Tri-Cities continues to be a story of adding value to the region’s agricultural bounty. Benton-Franklin Trends data illustrates the growth over the past 15 years of food and beverage manufacturers.

In 2021, the number of firms in the industry totaled 120. That’s nearly double the number of 2004. As a share of the total workforce, food and beverage manufacturing took up 4.7% in 2021. That is half as much as the share stood in 2004.

The count of these workers implied that nearly three out of every four workers in local manufacturing could be found in food processing plants. That’s up from two-thirds a decade prior.

It might surprise readers to learn that the largest growth in food manufacturing over the past decade has come from west of the river. The job count in Benton County increased by 800, while the count in Franklin County climbed by about 350.

In general, local manufacturing runs on the labor of the Latino/Hispanic population. The most recent Census data, from the third quarter of last year, reveal that 43% of all manufacturing jobs were held by this population. Since Latinos and Hispanics constitute about 34% of the two-county population, they are over-represented in manufacturing. Given the preeminence of food processing, it’s safe to assume that Latinos and Hispanics make up close to half of the workforce in this industry.

Higher wages?

Generally, manufacturing pays higher than average wages. This is not necessarily so in food processing, as wages are on the low end in the sector. Data from the Washington State Employment Security Department show the following for Benton County in 2021: an average annual wage in food manufacturing of $56,750 and an average annual wage in beverage manufacturing of $48,500. Wages in Franklin County for the same industries were lower.

As Trends data shows, the overall wage in both counties in 2021 was nearly $58,800. Consequently, food and beverage manufacturing firms paid lower than the all-sector average. Still, these are jobs that pay much higher than several large sectors, such as retail and hospitality.

Food processing dependence

What will the future of manufacturing in the area look like? Unless the trendlines change, an even greater dependence on food processing is likely.

From the perspective of exports, whether to domestic or foreign markets, this may be welcome: It is beneficial to have processors located here, given the large harvests of crops and production of cattle. They increase the value added that would be considerably lower if raw produce were shipped out of the region. (Value added largely consists of payrolls.)

Diversifying

Yet, as in investment portfolios, there is merit in diversification. The current profile of manufacturing in the greater Tri-Cities is the least diversified among Eastern Washington metro areas. Measured by headcount, Grant County sports the second-most concentrated manufacturing sector, with 53% of its manufacturing workforce in food processing. At the other end of the spectrum is Spokane County, where the headcount of its largest manufacturing industry, metal fabrication, amounts to only 17% of total manufacturing jobs.

What might be the opportunities for the manufacturing sector here to hedge its bets? If we believe in the value of clusters or concentrations as guides, we should consider what already exists. The next largest manufacturing industry, largely in Benton County, consists of chemical manufacturing. Readers may know which companies are a part of this industry, but this writer does not. But the average salary, at $105,000, is nearly double that of food processing.

Much smaller local manufacturing industries include metal fabrication and electronic product manufacturing. Their average salaries, too, are considerably higher than those of food processing, at approximately $78,000 and $84,000, respectively.

Of course, it is hard to diversify an economy, at least one in the U.S., via a master plan. Economic development often happens through serendipity. Think how Microsoft and Amazon started their businesses in King County. Or how Schweitzer Engineering Labs (SEL) did the same in Whitman County.

Beyond the moment of chance, however, was the presence of the University of Washington, providing high quality workforce to both King County tech giants. SEL is headquartered in Pullman because Ed Schweitzer was a professor of electrical engineering at Washington State University.

Might the recent investments in the energy sector here lead to spin-offs that will appear in future manufacturing data? Will the creation of an aviation biofuel center at WSU Tri-Cities contribute as well? There are certainly no guarantees, but the presence of local talent, backed by significant financial resources, gives hope to greater diversity of manufacturing in the future of Benton and Franklin counties.

Patrick Jones is the executive director for Eastern Washington University’s Institute for Public

Policy & Economic Analysis.

Opinion Manufacturing

KEYWORDS june 2023