Home » Benton, Franklin property valuation rates jump more than 20%

Benton, Franklin property valuation rates jump more than 20%

October 11, 2023

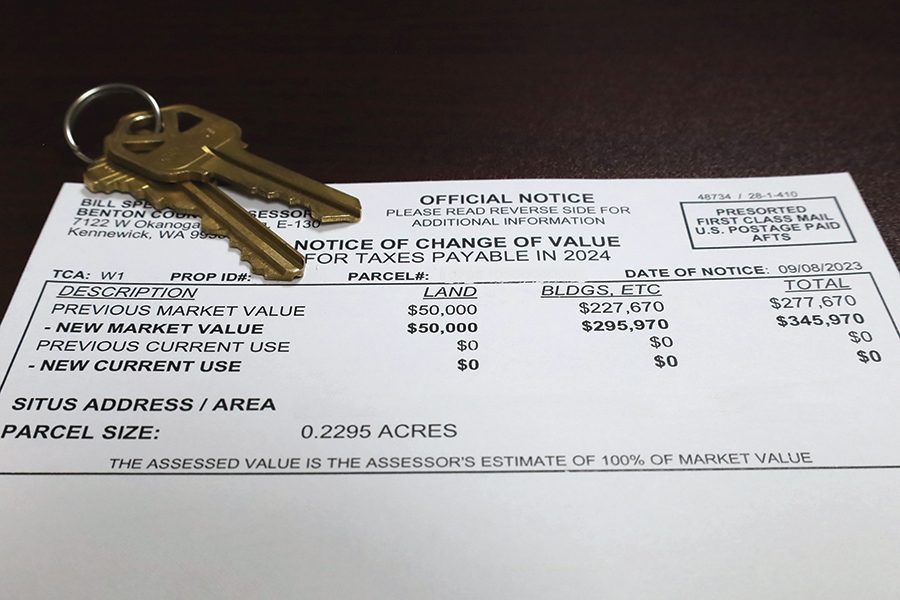

Scott Thompson had never felt strongly enough about an issue to display a banner criticizing elected leaders – until he got his property valuation from the Benton County Assessor’s office.

That’s when he put up the large sign on his wooden fence facing the well-traveled Keene Road in West Richland: “Ignorant voters + Incompetent assessors = Oppressive taxation.”

“It went up 26.4% in one year,” Thompson said of his property taxes. “I was surprised and so I went back to the only other postcard I had from 2020 to 2021, and it went up 3.6%, and I’m OK with that since it kind of goes up with inflation. But 26.4% is extremely excessive.”

Thompson’s valuation is in line with countywide trends, which averaged an increase in value of about 23% in Benton County and about 28% in Franklin County.

Thompson said homeowners shouldn’t have to pay property taxes on what someone else may pay for their home.

“Especially when they compare it to houses that are sold because they’re sold at their best condition. I need a $25,000 roof, I’ve got matted carpet upstairs; stuff that I don’t maintain at the level if I was going to sell my house. So why should I pay taxes on something so subjective and affected by so many things?” Thompson said outside the home he’s lived in for eight years.

He paid $275,000 for his home in 2015, marking a somewhat modest increase in value from when the home was built a decade earlier and sold brand new for about $221,000. Today, his home and property are assessed at $531,460, nearly double the value of what he paid for it.

Part of the shock Thompson felt when receiving his 2023 valuation came from his appraised value of $383,320 in 2021, followed by $420,350 in 2022 to the stunner of a more than $120,000 increase in a single year.

“Some people were saying the assessor was using Zillow to get the value, but when I looked into it, I saw the (comparisons) they used, and some are one-story when mine is a two-story, and others are at least a decade newer,” Thompson said.

Determining values

Zillow lists his home value slightly higher than the assessor’s office did, and both the Benton and Franklin agencies assure property owners that Zillow doesn’t factor into the yearly valuation process, which uses a three-pronged approach.

Assessed value is determined by using appraisal approaches to value: the cost approach, sales approach and income approach, said Benton County Assessor Bill Spencer.

“For the majority of residential properties, the cost approach is initially used to determine a replacement cost new. For example, how much would a house cost to be rebuilt from the ground up based on the price of materials. From this point, the sales approach is utilized, which analyzes arm’s-length sales to determine market value. The difference between valid sales and the replacement cost new is trended positively or negatively at a neighborhood level to arrive at 100% of market value.”

That 100% is what a property would really sell for in the current market, though values are based on sales ending in the previous calendar year and not what is seen at the time the postcards are sent.

Benton City and Prosser saw the smallest increases in Benton County, averaging about 18%, with north central Pasco averaging some of the lowest increases in Franklin with just under 14%.

Assessors evaluate neighborhoods as a whole and none saw a decrease in value.

“This does not mean individual homes, especially ones in our active revaluation area, did not individually lower in value if it was warranted after physical inspection or interview with the homeowner,” Spencer said.

Mass appraisals

Most properties are part of a mass appraisal, though counties do physically visit some districts at least once every six years, and properties where building permits are issued for value-adding improvements are inspected yearly.

For the most recent assessments, Benton County assessors visited Kennewick west of Highway 395 to the westernmost city limits, while Franklin County visited west Pasco properties mostly north and south of Sandifur Parkway, from about Road 84 in the east to Road 36 in the west.

As most home prices have stayed fairly consistent throughout 2023, or even softened, property owners may expect a less dramatic increase in a year’s time.

Assessments went out in August for properties in Benton County, while Franklin County’s went out at the end of May.

Neither county has calculated expected property taxes for the year, and homeowners shouldn’t expect those changes until early 2024. But a 24% increase in valuation doesn’t equal a 24% increase in taxes, courtesy of a state law that limits the combined property tax rate to 1% of market value, with voter-approved special levies, like those for schools, as an addition to this amount.

The 1% cap applies to a taxing district’s levy amount and is not affected by an increase in assessed value of a single property.

Hoping to combat the property owners who are uninformed of the true impact of their new assessment, Benton County has an explanation on the Assessor’s Office homepage with anecdotal examples, explaining, “The 1% limit applies to the maximum increase in tax revenue levied by an individual taxing district. It does not apply to individual homes, which tend to increase in assessed valuations at varying rates. Taxes on individual homes could increase by more or less than one percent depending on how they change in value relative to other properties in a district.”

Calling it a “perfect storm” for the timing of notices and the subsequent publicity, Franklin County saw valuation appeals shoot up, with most received at the end of September when fervor over Benton County’s assessments had created significant rumblings online.

“Around May, interest rates were up and the market was feeling the squeeze,” said Nikki Lyn Morgan, chief appraiser with the Franklin County Assessor’s Office. “Combine that with some very vocal property owners who do not understand appraisal or property taxes, and appeals are up across the state.”

In his last tax booklet, Franklin County Assessor John A. Rosenau included a letter reminding residents, “The assessor does not establish the dollar amount of taxes required nor does the assessor bill or collect taxes. The taxpayers, state limitations and assessed value determine the tax rate for each district.”

Franklin County had received 284 appeals as of the end of September, with 23 already going before the governing board and finding the assessor’s value sustained.

Despite seeing a somewhat similar jump in valuation year over year, Benton County said it’s receiving appeals on par with previous years, having received just a few dozen by late September.

“We encourage taxpayers to call or come in and speak with us before taking the step in filing a petition with the Board of Equalization,” Spencer said. “When data needs to be changed or updated, we can address it then and there rather than the taxpayer needing to start the entire appeal process. The bottom line is, we want to be accurate and fair, and if we need to correct something, we can do it without getting to the appeal process.”

West Richland’s Thompson isn’t sure if he plans to appeal. He was more motivated to change the state law requiring homes to be assessed at 100% of market value.

“I’m trying to find how to do a petition online. I would imagine it being pretty easy to get 200,000 signatures in the state of Washington to change the law,” he said.

Property taxes for the upcoming year are due by April 30 but half can be paid when the other half is paid by the end of October 2024.

Real Estate & Construction Local News

KEYWORDS october 2023