Home » The odds your new business will fail are high

The odds your new business will fail are high

October 11, 2023

Here are some tips to beat them

Tri-City experts say good planning and a good team can play key roles in setting new businesses up for success.

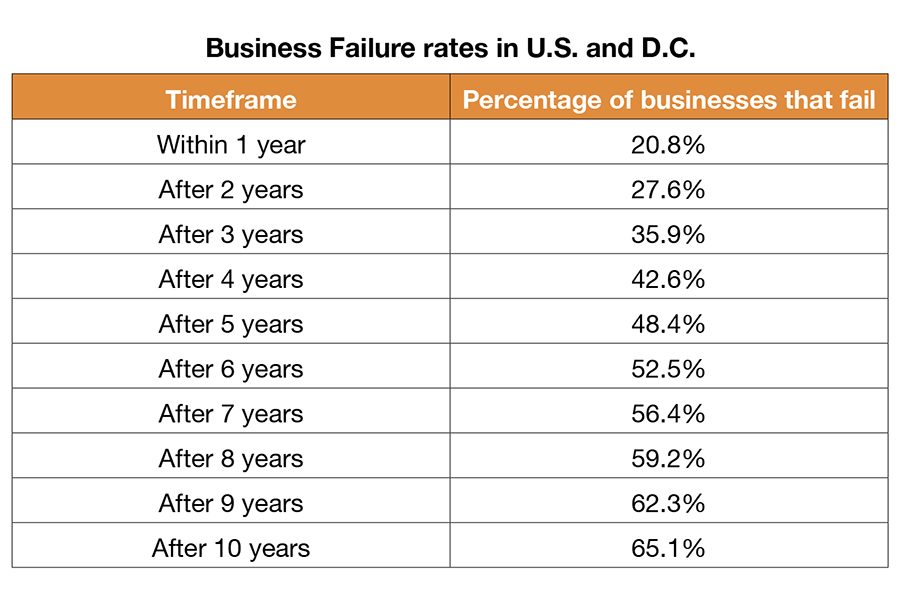

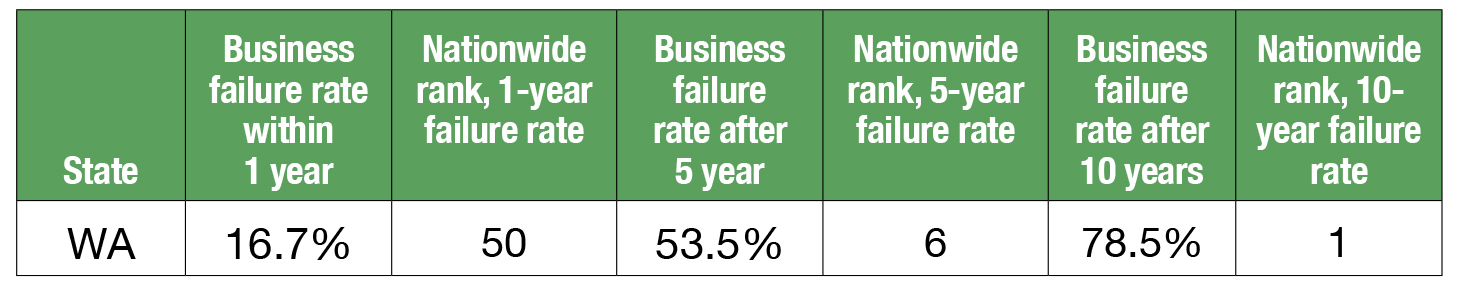

It’s solid advice since about 1 in 5 businesses nationwide fail within a year because they aren’t set up for long-term success or don’t understand some key aspects of owning a business, according to a report from LendingTree.

Businesses in the state of Washington have the second-lowest failure rate within the first year, with about 17% failing, according to the report.

But, the report noted that “although Washington has the second-lowest business failure rate (in the country) after the first year, it has the biggest failure rate after 10 years (78.5%). This long-term spike isn’t isolated, as the Evergreen State had the lowest one-year and highest five-year and 10-year failure rates during our 2022 examination.”

In the past three months, 612 new business owners in the Tri-Cities registered their new ventures with the Washington Charities and Corporation Filing System.

Why do small businesses fail? The report cites inflation, supply-chain issues, access to capital and bad luck as some of the reasons.

Creating a viable business plan that’s scalable and profitable is important, and while marketing is a fun and fundamental part of a business strategy, some of the less talked about nuts and bolts often get overlooked, experts say.

The less sexy topics of taxes, bookkeeping, insurance and banking are the power tools needed to drill down on success.

We talked with four professionals from these fields to get their best advice to ensure their future success.

Taxes

The saying goes that death and taxes are the two certainties in life. While that’s true, learning about tax obligations and creating a plan for them will help keep pumping life into your business. Taxes shouldn’t be a stressful task that puts business owners in an early grave either.

Online tax software isn’t a plug-and-play solution for business owners. Every business is different, and a certified public accountant can offer shrewd tax advice.

“Sitting down with a CPA and coming up with a strategic tax plan on how to avoid taxes where legally possible can save business owners thousands of dollars,” said Chris Porter, partner of PorterKinney CPA, which formed in 2014 and has offices in Richland and Kennewick.

Porter said that most people understand payroll taxes, but business owners need to understand their five tax obligations: income, sales, payroll, property (on real estate and equipment), and business and occupation.

Forgetting to pay taxes is one of the most common mistakes small business owners make, Porter said.

“They don’t hire a CPA or accountant when they start their business,” he said. “They’ll go to a CPA to file their taxes at the end of the year, and then find out that they owe thousands of dollars that they’ve already spent. They’ll start year one already behind on taxes.”

Porter recommends new business owners interview at least three CPAs, or licensed tax preparers, and find one within their first month or before even starting their business.

“People who are not used to owning a business are used to receiving a paycheck and having the taxes already withheld from the paycheck,” Porter said. “Being a business owner is completely different. You have to come up with a method to pay taxes, whether that’s paying quarterly or withholding from your own paycheck.”

Porter encourages people to think of their business like a member of the Avengers and assemble an expert team. A common mistake he sees business owners make is trying to do everything themselves.

“You have to get a team together,” Porter said. “For example, if you do your own payroll taxes, you’re subjecting yourself to 30-plus deadlines per year and if you miss one of them, you get a huge penalty.”

He recommended hiring an accountant, attorney, banker, insurance professional and graphic designer for most businesses.

Bookkeeping

Think of bookkeeping as a doctor’s checkup to make sure the business is healthy from the inside out. It can help businesses apply for loans and make sound decisions based on their companies’ financial health.

“Without bookkeeping, you can’t know where your business stands,” said Veronica Salazar, owner of BillaBillz in Richland. “How can you make business decisions today, tomorrow, or in the future if you don’t know if the business is going to survive? Having money in the bank doesn’t tell the full story and if you want a business loan or credit, you have to show cash flow.”

Salazar has worked in the financial industry for 28 years and her company provides bookkeeping services and bookkeeping training to empower smaller businesses to oversee their own books. She says that bookkeeping has become more complicated with the introduction of applications to collect money.

For example, if a processor, or app (such as Square) performs a transaction, it deducts a fee. A bookkeeper needs to know how to correctly report that transaction.

“It’s not just black and white like cash and checks in the old days,” Salazar said. “You could connect the dots. A bookkeeper needs to be able to track those transactions and everything that happens from Point A to Point B.”

A discrepancy in bookkeeping can skew the profit and loss of a business, such as if an expense is listed as a liability.

If a business gets audited, bookkeeping can provide the proof to protect a business by making sure the books and financial records are accurate. Salazar recommends new business owners understand the basics of bookkeeping.

“There’s more to bookkeeping than most people realize,” she said. “I like to ask business owners why they got into business. If they have a vision and they can’t read their financial reports, how do they know if they’re going to survive or if they’re going to grow?”

Insurance

According to the Small Business Association, 36% to 53% of small businesses are sued every year. It also reports that 90% of all businesses are involved in a lawsuit at some point. Having business insurance can help protect a business from a lawsuit.

“A business is an investment, and like other investments, they need to be protected,” said Robert Krug of Robert Krug Agency of Kennewick, part of American Family Insurance. “Without the proper coverage, you run the risk of losing your dream as a small business owner. They can be over just as fast as they started.”

Krug said that business insurance is usually an afterthought. Besides lawsuits, business insurance can protect a business and its assets from accidents and incidents including cyberattacks. However, it’s become harder to be insured and afford insurance. Between the rising costs associated with building materials and a rise in cases, the price of coverage had gone up.

“Underwriting has become more selective in what they approve,” Krug said. “The rise of natural disasters between fires and floods contribute to this.”

However, over-insurance is a common problem that Krug says he faces as well. He recommends meeting with an agent twice a year to ensure a policy properly represents and grows alongside a business.

Banking

To make money, capital is often required. Learning how to use a banker can help a business grow faster through financial management and loans.

To make money, capital is often required. Learning how to use a banker can help a business grow faster through financial management and loans.

Banks can provide business banking services and many types of loans such as small business loans (SBA Express, SBA 7(a), SBA 504), commercial real estate loans, lines of credit and equipment loans. However, in the case of loans, managing the risk is where the bank comes into play.

“Having realistic projections and backing are useful when you are asking for a loan,” said Cassandra Arey, business banker of Community First Bank, based in Kennewick. “We also look at collateral, cash flow and a secondary source of repayment.”

However, it’s hard to provide a loan to a new business. Usually, banks will require small businesses to have at least 24 months of operation before applying for a loan.

Even if a business does have capital available, loans allow them to keep cash flow separate from personal finances or to set up tax benefits down the line. It gives them the flexibility to qualify for accounting and tax benefits such as write-offs for interest.

“It’s another income deduction,” Arey said. “They might also not want to put all that cash in on the front. It’s an easier pill to swallow for many business owners. It depends what the end goal is.”

She said that she helps businesses find financial options. If a business doesn’t qualify for a business loan, there are other options such as a home equity line of credit (HELOC) loan or angel investors like the Tri-Cities Angel Alliance (tc-angels.com).

Local News Banking & Investments

KEYWORDS october 2023