Home » Kennewick student champions financial ed bill in Olympia

Kennewick student champions financial ed bill in Olympia

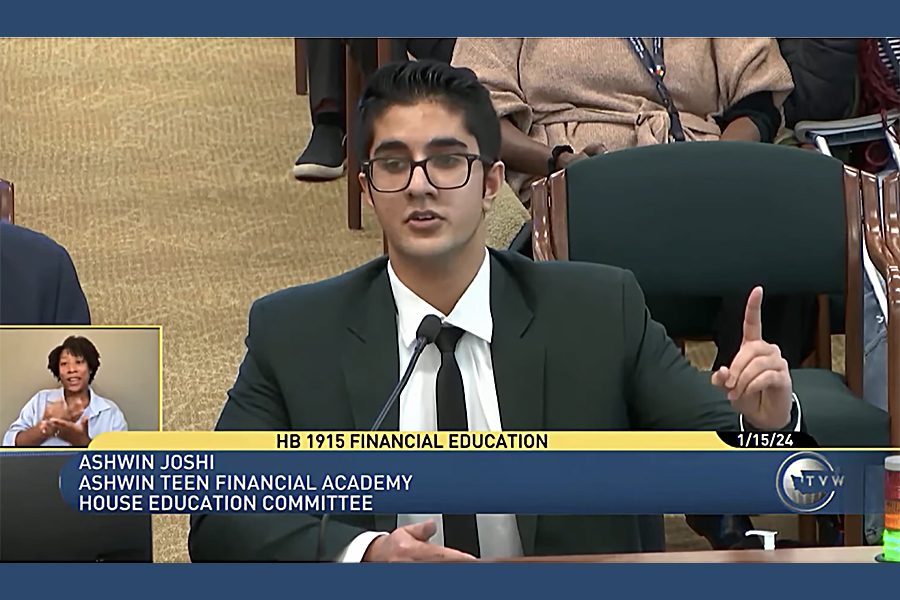

Ashwin Joshi, who attends Southridge High School in Kennewick, spoke Jan. 15 in favor of House Bill 1915 in Olympia. The state House of Representatives approved the bipartisan legislation on Feb. 8.

Courtesy TVWJanuary 16, 2024

A Kennewick senior who founded a nonprofit dedicated to financial literacy was among a handful of high schoolers from across the state who testified on a state bill that would require financial education as a graduation requirement.

Ashwin Joshi, who attends Southridge High School in Kennewick, spoke Jan. 15 in favor of House Bill 1915 in Olympia. The bill would make financial education a graduation prerequisite and a required component of public education.

The state House of Representatives approved the bipartisan legislation on Feb. 8. The bill now heads to the Senate for further consideration.

Financial literacy classes are graduation requirements in the Richland (1 credit) and Pasco (0.5 credit) school districts, but they are not a statewide graduation requirement. The Kennewick district does not require a financial literacy class to graduate.

House Bill 1915 would require public school students, beginning with the class of 2029, to take a half credit of financial education to graduate. Classes could be standalone courses or embedded into other courses and subject areas.

Rep. Skyler Rude

Rep. Skyler RudeThe bill also proposes requiring school districts, beginning in or before the 2026-27 school year, to provide financial education instruction to all public school students in elementary and middle school. State Rep. Skyler Rude, R-Walla Walla, prefiled the bipartisan bill in December.

Joshi told the House Education Committee that over the past three years he’s devoted himself to the cause of financial literacy through his nonprofit, Ashwin Teen Financial Academy, or ATFA. He’s been working on the bill since last August.

“My why for all this time is the fundamental truth of living in society is we make money-related decisions daily. It’s a constant presence in our life yet most of us are brought up learning that we need money to survive but not learning how to manage money to thrive,” Joshi told the committee.

“But with this bill, we make sure financial literacy is a fundamental right to all students, not a privilege for a few and by doing so we not only create better futures for our youth going forward, but we create better futures for their future families as well,” he said.

State Treasurer Mike Pellicotti said he’s heard from people all over the state about the need for greater access to financial education and literacy, mostly from adults. But he said he’s been excited to hear it from young people, too.

Marton Mezei of Lewis & Clark High School in Spokane told the committee via remote testimony that his parents grew up on the “wrong side of the Iron Curtain” and didn’t have a lot of money. He said his father instilled in him the values of finance at a young age, but he realized when he went to high school that he didn’t have a way to learn more on the topic, aside from business classes and through the Junior Achievement organization.

“This (bill) is a fantastic groundwork — a foundation necessary for personal and financial well-being for all,” he said.

Castillo Gonzalez of Chehalis, a high school member of the State Board of Education, said the board has some questions about the bill’s approach but is supportive of its policy intent, saying schools need to teach financial literacy as they can’t rely on families to do it.

“Since kindergarten, the only financial education that I can remember was learning how to count pennies and dollars,” Gonzalez said.

“... We lack knowledge about investing in stocks and essential life skills, like renting, managing credit, taxes and insurance. I think financial education should be a part of the learning experience because I already have to leave high school, having no idea of what I’m doing with money or how to handle it. Schools need to teach this.”

Ronan Maher of Bellingham, a member of the Legislative Youth Advisory Council, said his group was in favor of the bill. “We believe every young person deserves the opportunity to learn about financial literacy. This bill will help provide that opportunity to many Washington high school students who would not normally access this information that would help put them on a path of financial understanding and potential prosperity,” he said.

Also weighing in on the bill was the Washington Education Association’s Nasue Nishida. She said WEA supports the concept of the bill but expressed concerns about preparing teachers and the timing of the requirements in the bill, especially at the elementary and middle school levels.

Nishida said WEA would like to see how school districts are teaching financial literacy and requested an additional report from districts on what they are doing at the elementary and middle school levels and what their needs would be to get them ready to meet the bill’s requirements.

The number of people signed into the committee hearing totaled 171, with 162 listed as proponents of the bill and nine who were listed as “other.”

Latest News Education & Training

KEYWORDS January 2024

Related Articles