Home » Business community wary of minimum wage increase

Business community wary of minimum wage increase

November 15, 2016

What will the passage of Initiative 1433 — raising the minimum wage to $13.50 an hour by 2020 — mean to small businesses in the Tri-Cities?

To Don Karger, owner of Henry’s Restaurant & Catering in West Richland and his eight employees, it could translate to an $11,000 drop in his personal income.

With the passage of I-1433, that’s how much he’s calculated the extra wages would cost his business if he does not raise prices. His income from Henry’s ultimately will take the hit.

His other option? Raising prices and hoping competitors will do the same.

“Does anyone want to take an $11,000 cut in their income next year?” he said.

He said large businesses will be able to deal with a higher minimum wage than small ones. “There will be some businesses that can’t absorb it,” he said.

Karger also criticized the “one-size-fits-all” aspect of a statewide increase in the minimum wage, noting Kennewick is a much cheaper place to live than Puget Sound.

The initiative was passing statewide with 59 percent supporting it on Election Day.

Benton (60 percent) and Franklin (59 percent) county voters didn’t support it in Election Day preliminary results. The election is scheduled to be certified by Dec. 8.

Benton (60 percent) and Franklin (59 percent) county voters didn’t support it in Election Day preliminary results. The election is scheduled to be certified by Dec. 8.

Karger expected the initiative to pass before the election, calling it “a feel-good thing.” For the same reason, he does not expect the Legislature to put brakes on it after two years pass for its first legal opportunity to do so.

“For years, the minimum wage has been a top issue for our members and this initiative only adds to those concerns,” said Lori Mattson, president of the Tri-City Regional Chamber of Commerce. “The cost of living gap between Western and Eastern Washington is significant and what works in Puget Sound is not necessarily the best solution for communities like the Tri-Cities.”

Such an increase could hurt job retention and economic growth, she said.

Washington has the seventh highest minimum wage among the 50 states and the District of Columbia.

With the passage of I-1433, the state will be No. 2 at $11 an hour in 2017 — still stuck behind Washington, D.C., which has a minimum wage of $11.50 an hour. And there’s Seattle, which will be $11 to $13.50 an hour in 2017, depending on the size of the business.

Zillions of minimum wage numbers are floating around, and we’ve snared a few to give you an idea of how the Tri-Cities will compare.

Washington in a non-I-433 world

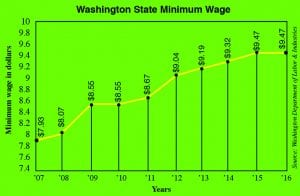

The hourly minimum wage is currently $9.47 and was on track to be $9.53 in 2017 and slightly more than $10 in 2018. Washington’s minimum wage increases almost annually based on a complicated formula involving the federal consumer price index.

Washington in an I-1433 world

The minimum wage goes from $9.47 an hour to $11 an hour on Jan. 1, 2017. It will hit $11.50 in 2018, $12 in 2019, and $13.50 in 2020. Also, paid sick leave becomes mandatory, adding to benefits for employees, but also to the costs on businesses.

How does all this compare to Seattle?

Seattle’s minimum wage picture is complicated with three paths to a $15-an-hour target. Its formulas are based on whether a business employs 500 or fewer people, 500 or more people, or 500-plus including providing health insurance. On Jan. 1, Seattle will hit $11 for the small employers, who will reach the $15 mark in 2021. Big businesses in Seattle will hit $15 in 2017 without health insurance, or will end up at $13.50 in they provide health insurance. The big firms with health insurance will reach the $15 plateau in 2018.

So who has the lowest minimum wages?

Nineteen states are at the federal minimum wage level of $7.25 an hour. Business people in Spokane, Pullman and Clarkston know that Idaho is one of those. The next nearest states at the $7.25 level are Utah, Wyoming, North Dakota, Iowa and Oklahoma. The rest are east of the Mississippi River.

Local News Labor & Employment

KEYWORDS november 2016