Home » Homeowner’s insurance might not cover theft from storage units

Homeowner’s insurance might not cover theft from storage units

March 15, 2017

By Sean Bassinger

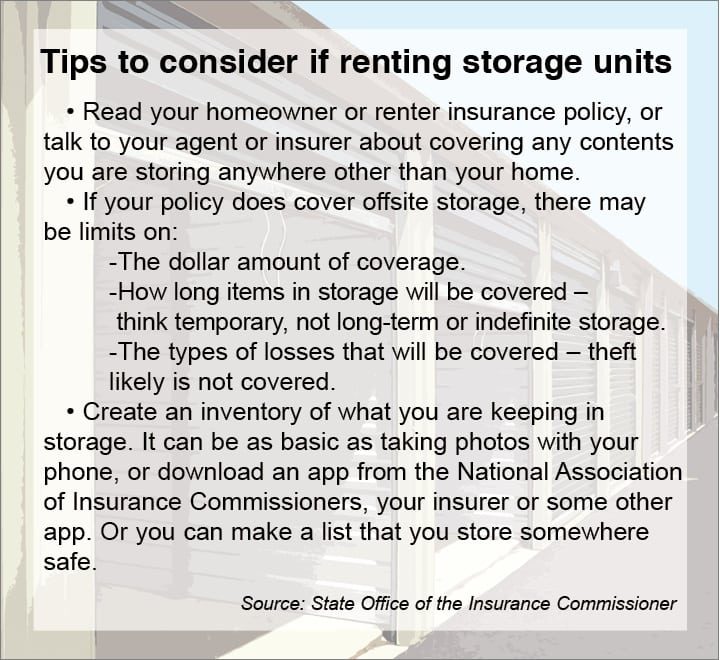

Belongings stashed inside self-storage units may not be covered by homeowner or renter insurance policies if anything gets stolen or damaged.

Policies that cover items at off-site storage units may have limits in place as well, according to the state Office of the Insurance Commissioner.

It’s good information to find out before moving high-value items into a storage unit.

And people are using them more than ever, with nearly 10 percent of Americans renting a storage unit in 2015, according to Sparefoot.com, a storage unit comparison site.

The self-storage industry was expected to generate $32.7 million last year.

State officials advise against storing anything of high value, such as art, antiques, jewelry, collectibles, furniture or rugs.

Unless renters have had the items appraised and insured for those amounts, it’s likely the dollar limits on your coverage will not be enough to pay to replace the possessions if they are damaged, according to the insurance commissioner’s office.

Jeff Wenner, owner and operator of Queensgate Storage in Richland, said it’s uncommon for people to store goods of high value.

“Those are far and few in between, in my opinion,” he said.

Wenner and his wife have owned Queensgate Storage since 2011. Since then, they’ve seen five units auctioned off.

“None of those units had anything of high-value individual items,” Wenner said. “Generally, it’s old (recliners) and photo albums.”

Queensgate Storage currently has about 215 tenants, a fraction of whom have inquired about possible insurance outside of their own homeowner’s or renter’s policies.

Though the facility has security cameras, motion lights and gates that lock around 9:30 p.m., Wenner said customers should still be smart about what they store. Their units aren’t climate controlled, so Wenner also advised against storing electronics, such as televisions.

“We take precautions to ensure the security of the folks that rent with us,” he said.

If requested, Wenner can work with customers to get insurance. Plans typically start at an extra $10 a month for about $5,000 worth of coverage. He said plans could cover up to $15,000 worth of goods.

These plans cover fire, flood or other damage related to climate, but Wenner said he’s uncertain if they cover theft. Wenner recommends anyone who rents a unit and stores goods should double-check their homeowner’s or renter’s insurance company.

“Either renter’s insurance or homeowner’s insurance — both of those usually cover off-site storage,” Wenner said.

Lisa Stump, office manager at Tri-Cities’ Legacy One Insurance, said most homeowner insurance policies cover personal property while it is anywhere in the world.

“There can be some limitations to personal property at a self-storage facility. Some insurance carriers limit coverage to property in self-storage to 10 percent of the personal property limit shown on the policy. For example, if there is a $100,000 personal property limit on the homeowner insurance policy, there would be up to $10,000 coverage for items in self-storage,” she said.

“There can be some limitations to personal property at a self-storage facility. Some insurance carriers limit coverage to property in self-storage to 10 percent of the personal property limit shown on the policy. For example, if there is a $100,000 personal property limit on the homeowner insurance policy, there would be up to $10,000 coverage for items in self-storage,” she said.

The type of insurance coverage extended to items in self-storage would be the same as listed for personal property on the policy. There usually is no additional charge, she said, adding that customers should ask their insurance agent if they’re contemplating putting personal property in storage.

Officials at the state insurance commissioner’s office said consumers should shop around and talk to their agent, broker or insurer to see what their policy covers, said Kara Klotz, public affairs and social media manager at the state insurance office.

Coverage could depend on what people store and for how long, Klotz said. She said items of high value should be appraised so consumers can find the best coverage possible.

“Items with higher dollar values may also exceed the limits of a standard policy,” Klotz said.

A standalone storage unit policy will typically cover contents for a longer period of time than a homeowner or renter policy.

“If you plan to store things for an extended period of time, you may want to look into a separate policy,” Klotz said.

Shoppers should make sure any company or agent they work with are licensed to do business in Washington. The state office also recommends consumers ask their friends if they’re happy with an agent or company.

In addition, consumers should read up on their policies and ask questions if they’re uncertain what’s covered.

“We also recommend that people make an inventory of their contents, which is good advice whether your belongings are in storage or are in your home,” said Mike Kreidler, Washington insurance commissioner. “The claims process goes much more smoothly if you can prove to the insurance company what you lost.”

Consumers can look into phone apps to help them manage their inventory with photos or via a spreadsheet. They also should let state officials know if they have any trouble with a policy, insurer or agent, Kreidler said.

For more information, visit insurance.wa.gov.

Local News Insurance

KEYWORDS march 2017