Home » WA’s tax competitiveness ranks among lowest in nation

WA’s tax competitiveness ranks among lowest in nation

November 14, 2024

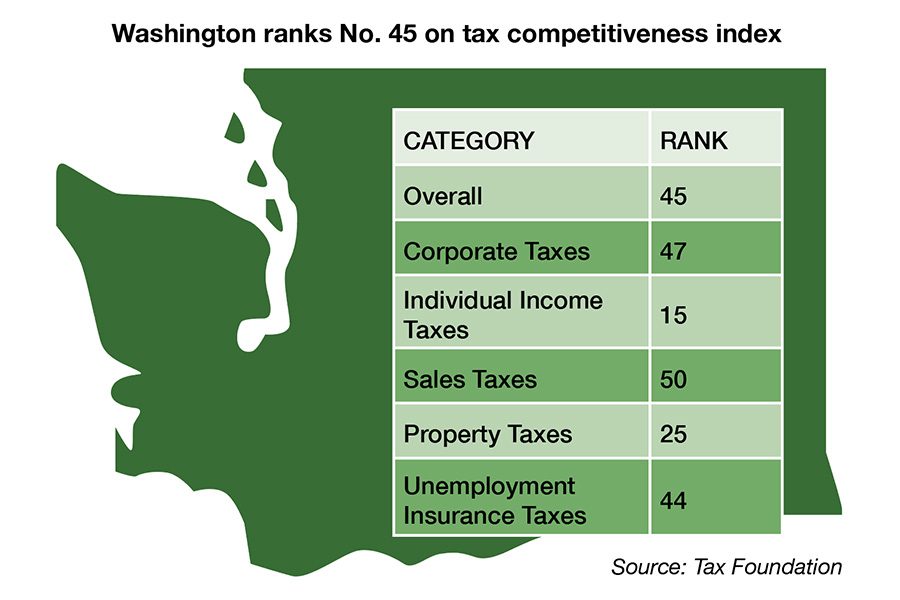

Washington is among the lowest-ranked states on the Tax Foundation’s State Tax Competitiveness Index, coming in at No. 45.

The index provides an overall ranking as well as rankings across five topics – individual income taxes, corporate taxes, sales and excise taxes, property and wealth taxes, and unemployment insurance taxes.

Though Washington doesn’t have an individual income tax on wages, it recently imposed a tax on high earners’ capital gains income, a policy that raised constitutional questions but ultimately secured the assent of the state Supreme Court, the foundation noted.

The foundation said Washington imposes a high multiple-rate gross receipts tax, called the Business & Occupation Tax. “Because it is based on gross revenues rather than net income (profits), it yields very high rates of taxation on low-margin businesses and leads to tax pyramiding, where goods and services have the tax embedded several times over, imposed on each transaction within the production process,” the foundation said.

The state’s sales tax, imposed atop the gross receipts tax, “is not just a high rate but is also imposed on a base that includes an unusual share of business inputs, particularly in the digital products space. Washington also levies a progressive real estate transfer tax and the nation’s highest-rate estate tax,” the foundation said.

It also pointed at Washington’s high unemployment taxes and an uncompetitive unemployment tax structure as contributing to the state’s “poor” index ranking.

The foundation, a nonpartisan tax policy nonprofit, said the list allows policymakers, taxpayers and business leaders to gauge how their states’ tax systems compare.

A high ranking on the index indicates structurally sound tax systems that prioritize broad bases and low rates. States that forgo one or more of the major taxes tend to do well, but so do states that prioritize neutrality while imposing all major tax types. For instance, Indiana ranks in the top 10, and Idaho, North Carolina, Missouri, Arizona, Michigan and Utah all find themselves in the top 20 despite imposing all major taxes.

The states landing near the bottom of the rankings, like Washington, tend to have several issues in common: complex, nonneutral taxes with comparatively high rates, the foundation said.

They typically have high and progressive income tax rates; impose harmful gross receipts, capital stock, and bequest taxes; penalize capital investment through poorly designed corporate taxes; and have ill-structured sales tax bases that include a disproportionate share of business inputs.

The index, now in its 21st year, provides an even more comprehensive evaluation of state-by-state tax provisions than its predecessor. With an updated methodology and presentation, the 2025 Index invites users to easily examine and compare states’ tax policy choices.

“States are in competition with their neighbors and, increasingly, even globally,” said Andrey Yushkov, a senior policy analyst at Tax Foundation’s Center for State Tax Policy. “State tax systems – not just how much they raise, but how they choose to raise it – affect investment choices, location decisions, and economic growth. The State Tax Competitiveness Index rewards states for structurally sound, pro-growth tax policies, making it a useful tool for policymakers who want their states’ tax systems to be welcoming to business and human capital.”

Go to: taxfoundation.org/statetaxindex.

Latest News Local News Taxes

KEYWORDS November 2024

Related Products